Majority minority census tracts aren’t just data points—they’re vibrant communities where thoughtful lending can drive both opportunity and equity. With tools like GIS and census demographic data, lenders can responsibly expand their reach, support homeownership, and contribute to long-term community growth.

The majority minority census tract represents one of the most dynamic, diverse, and underserved markets in the country. With MMI and our use of geographic information systems (GIS), lenders gain access to census demographic data insight and powerful tools needed to identify opportunity, drive equitable access, and grow strategically in these high-impact areas, engendering demographic diversity.

A majority minority census tract refers to a specific geographic area where over half of the residents identify as part of a racial or ethnic minority group. These tracts play a critical role in understanding the economic, social, and housing challenges—and offer thoughtful lenders the ability to drive both opportunity and equity—within underserved communities.

For mortgage lenders, real estate professionals, and housing advocates, these tracts are more than just statistical areas—they’re where real impact happens. They represent a chance to build trust, improve access, and create more inclusive pathways to homeownership. These communities have also become a key focus for CRA compliance, fair lending strategies, and affordable housing initiatives.

Majority minority census tracts are often:

At MMI, we use geographic information systems (GIS) to help lenders and housing professionals see the full picture. These powerful tools allow you to layer critical datasets—like household income, ownership rates, and demographic breakdowns—so you can spot high-potential, underserved areas with confidence.

Rather than relying on outdated maps or generalized insights, GIS allows for live, hyper-local views of where opportunity meets need.

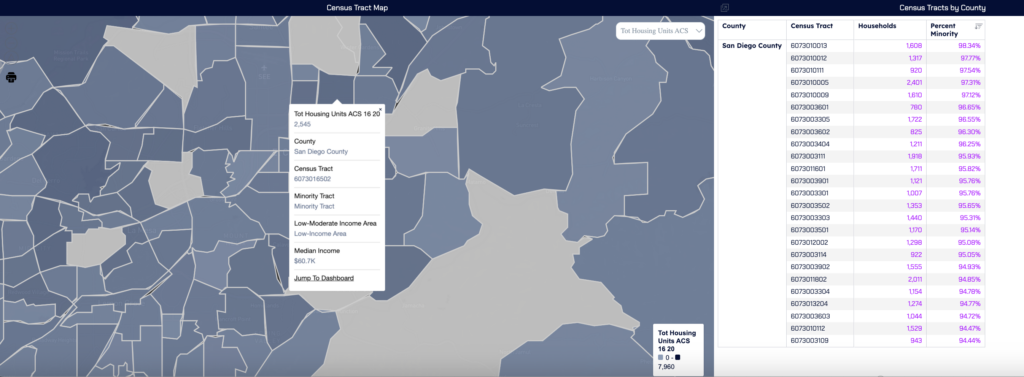

A look at a Census Tract Map in MMI for San Diego County, showing Minority Tract and LMI Area info–along with the Median Income for the region.

With MMI’s GIS-powered dashboards, lenders get access to:

This kind of detailed intelligence helps lenders expand strategically—while staying aligned with fair lending expectations and community reinvestment goals.

Through curated census demographic data, MMI uncovers where populations are shifting—and why. From migration trends to household growth, our tools reveal where the next generation of homebuyers is emerging.

For example, if a suburban county sees a sharp increase in Hispanic households, that signals a growing need for bilingual LOs or Spanish-language marketing materials. That kind of insight isn’t just useful—it’s transformative.

Demographic diversity opens up a world of opportunity for lenders who know how to respond. It means:

With MMI, your teams can build market-specific campaigns that speak directly to each tract’s unique identity—because one-size-fits-all doesn’t fit anyone anymore.

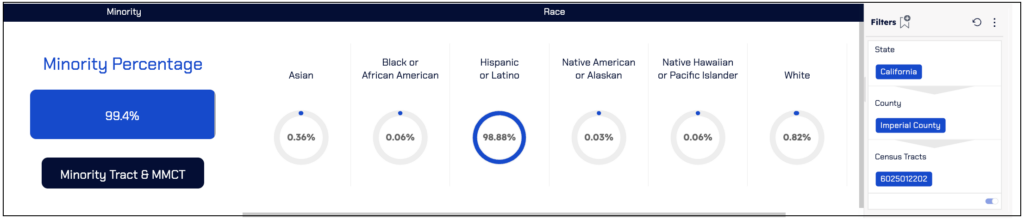

From MMI: A breakdown of the percentages of various minority groups within a Census Tract

Many majority minority census tracts overlap with low- to moderate-income (LMI) zones. That often means residents face real barriers to homeownership, such as:

From MMI: A breakdown of the percentages of various minority groups within a Census Tract

MMI helps break down these barriers by giving lenders a clear view of tract-level trends—from income to equity—so they can deliver the right products to the right people.

Here are a few ways lenders are making a difference using MMI:

Various products along with state bond programs often include eligibility incentives for borrowers living in majority minority census tracts.

MMI enables lenders to instantly locate these areas, match them to program criteria, and deliver mortgage solutions that improve access and retention.

When you combine MMI’s market intelligence with our unified ecosystem, you get a full-service lending solution built for underserved communities:

Together, these tools support a full Lead → Loan → Loyalty journey that’s built to serve and scale within majority minority markets.

An overview of the Unified Mortgage Technology Solution that MMI provides including MMI Data Center, Bonzo and MonitorBase–along with Pathways Home (coming soon).

Discover how MMI helps lenders lead with better data, build smarter partnerships, and create real impact to drive demographic diversity—right where it matters most.

Book a Demo to Learn More About Accessing this Data Today!

Explore MMI + MonitorBase + Bonzo

Read this complementary blog post, “Tools You Can Use to Market to Real Estate Agents.”