Discover how predictive mortgage alerts can enhance your lending strategy by spotting borrower intent before a credit pull. Learn more today!

In the mortgage business, timing is everything. Once a borrower starts thinking about a refinance or a new home, the clock is ticking. Many lenders still wait for a traditional sign—like a credit pull—to know someone is ready. The problem is that by the time that happens, the chance to win their business is already smaller. Another lender may have already called, and instead of being their trusted advisor, you’re just another option. Predictive mortgage alerts change this. They let you spot borrower intent earlier, so you can step in with the right offer before anyone else. Paired with MMI’s market insights and MonitorBase’s smart analytics, you get a strategy that’s proactive, data-driven, and built to keep you in front.

In the old model, lenders react to signals like a credit pull. It’s been the go-to sign that a borrower is looking for a loan. The trouble is that by the time you see that signal, they might already be talking to someone else. Credit-trigger leads are crowded—borrowers can get calls from multiple lenders within hours. Your outreach blends in with everyone else’s, and now you’re competing on rates and terms instead of building a real connection. Predictive mortgage alerts change that. They flip the timeline so you can reach out at the start of the borrower’s journey, when trust is still forming and there’s little competition. This is one of the best ways to find a refi opportunity before the borrower even realizes it’s time to act.

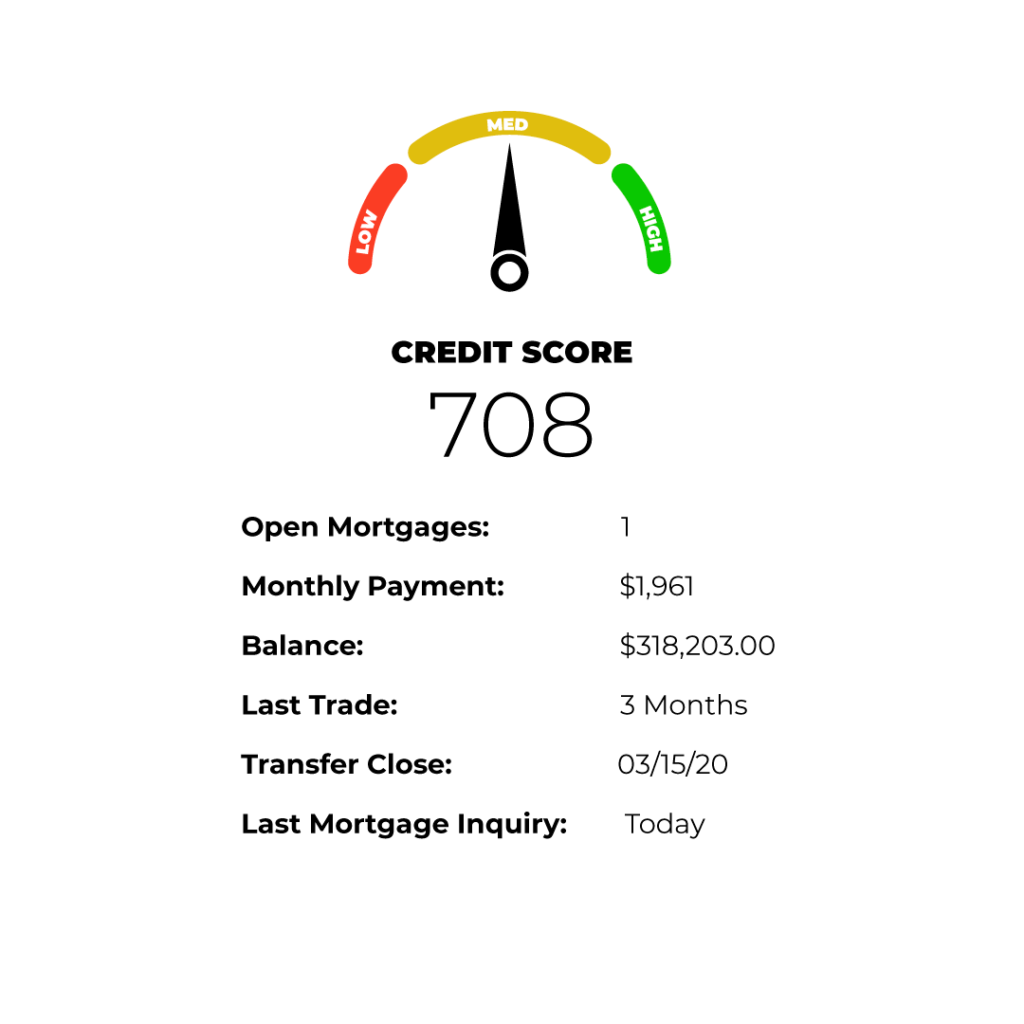

Predictive mortgage alerts use AI, machine learning, and smart data tools to find signs that a borrower is getting ready to make a move—long before they fill out an application. These systems watch a wide mix of data to build a clear view of borrower behavior and market trends. They track online property searches, looking for people who view listings or save homes on sites like Zillow or Realtor.com. They follow credit activity patterns like paying down debt, lowering credit card balances, or making changes that could improve a credit score. They look at home value changes through Automated Valuation Models (AVMs) to see if equity has grown enough for a cash-out refinance, mortgage insurance removal, or a second property. They monitor local economic trends, such as job growth or interest rate shifts, that can spark buying or refinancing. And they watch for life changes—moving, listing a home, or even changing jobs—that signal someone’s about to need a loan. When you pull these signals together, you can spot borrowers right before they take action. Finding a refi opportunity at this stage means you can show them the best options before anyone else calls.

Getting an alert is only valuable if you can act on it fast. That’s why they should be built into your existing sales tools. With CRM integration, alerts flow straight into your system, so your team can see them alongside past interactions and borrower details. You can set up automated campaigns that start instantly—emails, texts, or letters based on the borrower’s exact situation. If someone’s flagged for mortgage insurance removal, they can get a quick message explaining the benefits and how to start. Speed matters here—reaching out within minutes makes it far more likely you’ll connect while interest is high. Having sales playbooks for common situations—refinances, second homes, mortgage insurance removal—helps your team respond with confidence and consistency. MonitorBase alerts drop right into your workflow, and when paired with MMI’s deep market and lender data, your outreach is not only fast but also highly targeted, which means you can make the most of every refi opportunity or new loan lead.

A mid-sized lender using MonitorBase Predictive Scenario Alerts with MMI’s market data saw an alert for a past client. The borrower’s credit use had dropped, home equity was up by 20%, and they’d been browsing listings in a nearby city. That alert went straight into the loan officer’s CRM, creating a task to reach out with a custom offer for a cash-out refinance. The idea was to use the funds for home upgrades or to buy a second property. Because the call happened before the borrower had talked to anyone else, it was a friendly, helpful conversation—not a rate war. The loan officer spotted and secured a refi opportunity weeks before any competitor reached them. Within two weeks, the application was in. By the end of the month, the deal closed. The lender added revenue, the borrower got the loan they needed, and the relationship grew stronger for the future. This keeps happening for lenders who use predictive alerts. The difference is always timing—getting there first makes all the difference.

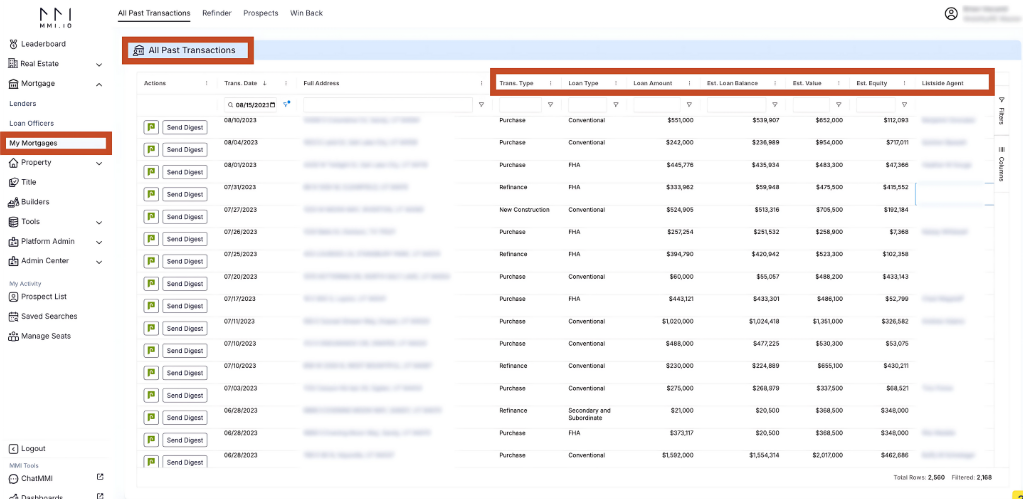

Use MMI Data Center to identify “All Past Transactions” in any time frame you choose to help you pursue the most promising opportunities where you can be of most help.

Predictive alerts tell you when to act. MMI’s market intelligence tells you where and how to focus. Together, they create a powerful strategy. MMI can help you target markets with the biggest potential and find the referral sources worth your time. By combining MMI’s borrower profiles with MonitorBase alerts, you can match the right offer to the right person at the right moment. You can see where competitors are gaining ground and adjust when alerts show a borrower is likely to move in those markets. You can also uncover cross-sell opportunities, turning one loan into a long-term relationship by offering other products that fit their needs. Using both tools means every refi opportunity or purchase lead comes with more insight, better targeting, and a higher chance of closing.

In this business, being first is everything. Waiting for a credit pull leaves you in a crowded race where the borrower’s attention is already split. Predictive mortgage alerts let you connect while they’re still deciding, not after. Pair that with MMI’s market insights, and you have a system that keeps you ahead, helps with borrower retention, and finds more refi opportunities than ever. The lenders who succeed in the years ahead will be the ones who act early and build these alerts into their daily process. With MMI and MonitorBase, you can stop reacting and start leading—getting to borrowers before anyone else even knows they’re ready.

Ready to see how MMI and MonitorBase can transform your lending strategy? Contact us today to learn more.