For its loan officer recruiting efforts, every lending company has its own set of criteria to qualify a loan officer as ‘top-performing,’ depending on current economic conditions and company initiatives. It’s critical in recruiting to be able to access and filter loan officer production and performance data so you can find and recruit the best loan officers at specific lenders.

The mortgage industry is highly competitive, with myriad lenders vying for market share – this is why loan officer recruiting is so important. There are more than 4,300 lenders in the US with about 2,500 top performing loan officers. Recruiting and retaining top talent is crucial for a larger slice of the pie. Every lending company has its own set of criteria to qualify a loan officer as ‘top-performing’. This depends on current economic conditions and company initiatives. It’s critical in recruiting to be able to access and filter loan officer production and performance data. Focus on this so you can find and recruit the best loan officers at specific lenders.

loan officer recruiting is a dynamic process influenced by industry trends and statistics. Research suggests a yearly turnover rate of around 30% for loan officers, with some companies experiencing even higher rates among rookie loan officers. This high turnover can be attributed to factors like unclear job expectations and inadequate training.

According to BambooHR, 23% of professionals who quit their jobs within six months of hire indicated they would have stayed had they been given better direction on what the job responsibilities and expectations were. More than 20% said they would have considered not leaving had they been given better training. Furthermore, almost 45% of new employees leave their jobs because they do not feel they have been properly set up to succeed. While ensuring you retain your top performers, you can capitalize on these trends as you look to build out your roster.

In this blog post, we’ll explore the strategies and tools you need to evaluate, recruit and retain top loan officers. This will help to ensure your organization’s ongoing growth and success.

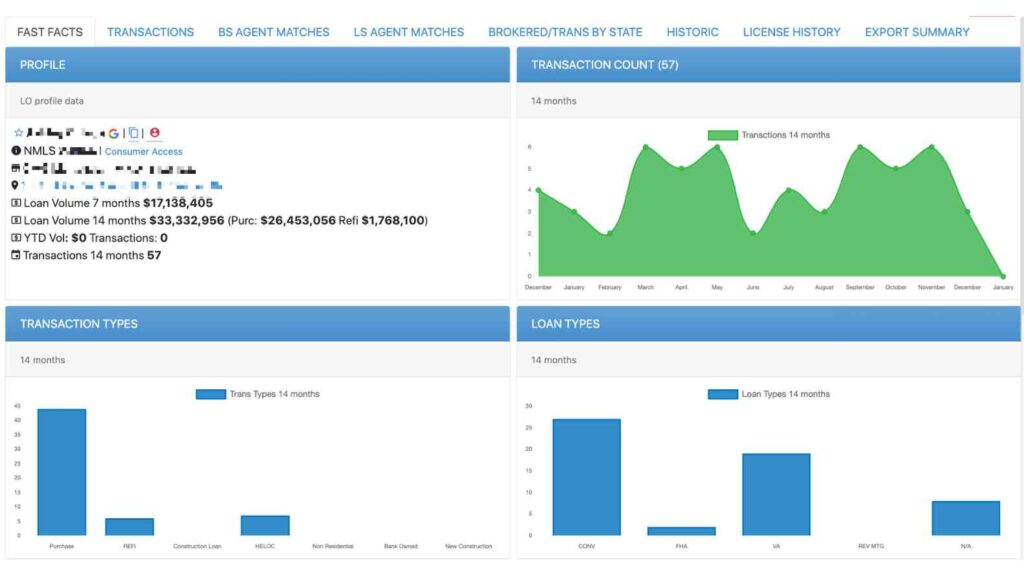

Utilize a mortgage data platform to check loan officer performance metrics.

Performance metrics play a pivotal role in assessing the capabilities of loan officers. Volume, efficiency and value are key indicators to consider. Volume refers to the number of loans they have processed. As far as efficiency is concerned, a loan officer’s average processing time should be considered. When we refer to “value”, we are looking at the value of the individual and cumulative number of loans they are processing. Our post on top loan officer performance metrics helps you learn more about this.

High-performing loan officers consistently process a significant number of loans. However, it’s essential to analyze this metric alongside other factors to understand the quality of their work. Consider the agents and teams they work with and the types of loans they are processing. Also look at how they stack against loan officers producing similar volume.

To help lenders and recruiters visualize the different levels of performance a loan officer, MMI creates and organizes content to categorize loan officers into tiers. These tiers are based on production volume (i.e., Tier 1 – Unicorn: $100M+, Tier 2 – Diamond – $50M-99M, Tier 3 – Platinum: $20M-49M, etc.).

Efficiency matters in the mortgage industry. According to Realtor.com, the mortgage process takes about 30 days on average. This takes into account the different parts of the process including pre-approval, home appraisal and procuring the actual loan.

During those months in which there is a higher volume of mortgages processed, it can take an average of 45-60 days. This depends on the lender and if there are financial issues in a borrower’s record like previous foreclosure, massive debt or low credit scores. All of these add to a longer and more complicated process.

Loan officers who can process loans quickly while maintaining accuracy demonstrate strong organizational skills and effective communication with borrowers. The faster a loan officer can process a loan, it should follow that they can process a higher volume of loans.

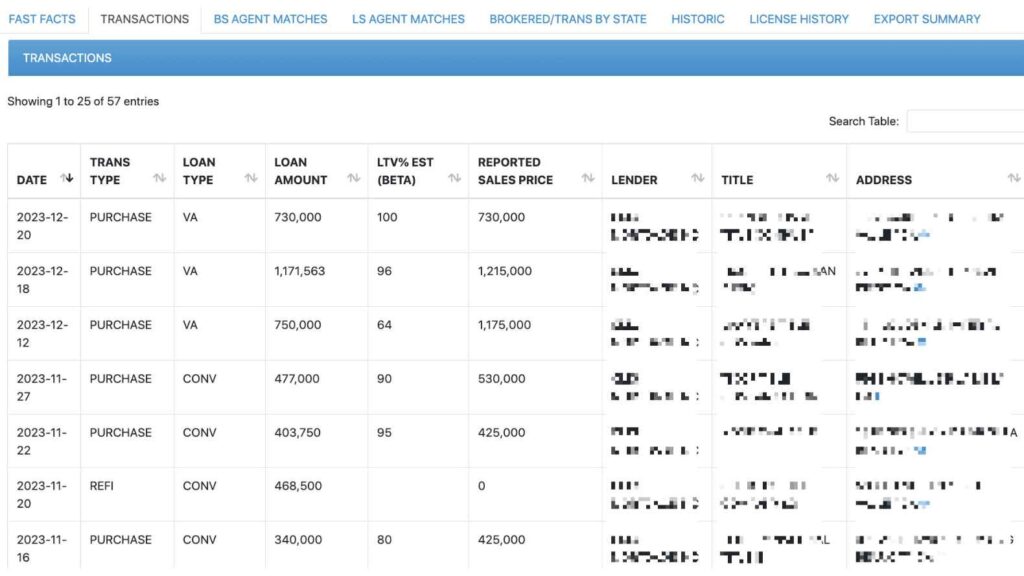

With the right data system for loan officer recruiting, you’ll be able to see the value and volume of business a loan officer does with specific real estate agents. With this type of information, you’ll have a better understanding of the ways a new loan officer might benefit your office. Are they working with all the agents your team has established relationships with, or are they bringing a potential bevy of new business?

When asked what loan officer data a recruiter pays attention to when using a data guidance system like MMI, Charles White, Vice President-Area Sales Leader-Atlantic Region, Synovus Bank shared the following during a webinar:

“I pour into the realtor connections looking to see patterns and establish how many relationships they have. Like the Bee Gees sang, ‘How deep is your love?’ Then I scour through the transactions to find median loan data instead of a plan average. Seeing where the properties are helps us get a feel for how much local business is being done. I always ask myself, ‘Will this LO help our bank partners grow relationships?’”

Having access to this type of agent relationship data is critical to the success of your recruiting process. And ultimately to the overall team and organization. Make sure the tools you are evaluating offer this type of information and the ability to easily search and filter.

Creating a comprehensive loan officer recruiting strategy involves setting goals, defining techniques, and assembling a skilled recruiting team. Be sure that key stakeholders have reviewed, weighed in on, and approved your strategy. You’ll want to be sure to have processes mapped out along with the sources and tools. Finally, you want key performance indicators (KPIs) that align with your organization and also each department.

Different departments have specialized needs: be sure you are in-step with them and their unique specifications. You’ll probably have a customized process to support those that oversee the loan officers within your organization. Example: you engage with potential loan officer recruits through networking. You may wish to request a business plan during the interview process. This allows you to gauge their commitment and alignment with your goals.

Have a Retention Plan in Place

In addition to a recruiting strategy to add new talent to your team, build and implement a retention plan. This ensures the long-term success of your loan officers. A retention plan should address potential attrition factors and emphasize your organization’s strengths. To help retain your most talented loan officers, develop a continuous feedback loop. This makes sure you are getting information back from them to verify they are receiving the support they need to succeed. If they are not, have them identify what you need to add and work to implement and explain why.

For loan officer recruiting, a loan officer database or data guidance system is a critically important tool in your arsenal. It enables you to quickly access key performance data and insights that we’ve addressed, facilitating informed decision-making. By leveraging such a system, you can identify top-performing loan officers based on concrete data, enabling targeted outreach. A data guidance systems like MMI give recruiters, business development teams and talent acquisition teams insight into an overall “story” about targeted loan officers. It is key when an organization is looking for the right fit that they have access to the right data. This includes numbers, trends, product types, agent relationships, and other types of data that fit with the narrative they want to tell.

As noted above, use a mortgage data tool to consider a number of different metrics, including:

Loan Volume,

Analyzing these metrics helps recruiters identify loan officers who possess the necessary skills and work habits to succeed in a competitive market. Our post on top loan officer performance metrics provides a helpful roadmap for what to look for.

Access loan office production and performance metrics utiizing a data guidance system like MMI.

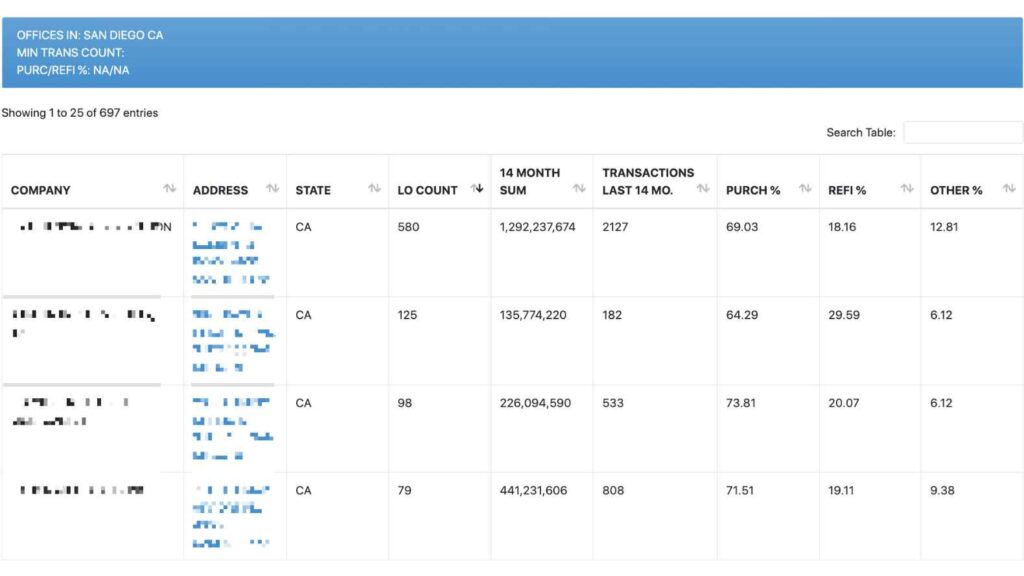

Lender office performance often relies on the collective effort of loan officers. For loan officer recruiting, researching high-performing lender offices and analyzing their loan officer roster can provide valuable insights into potential recruits. Geographic data, combined with performance metrics, offers a strategic advantage in your recruitment efforts.

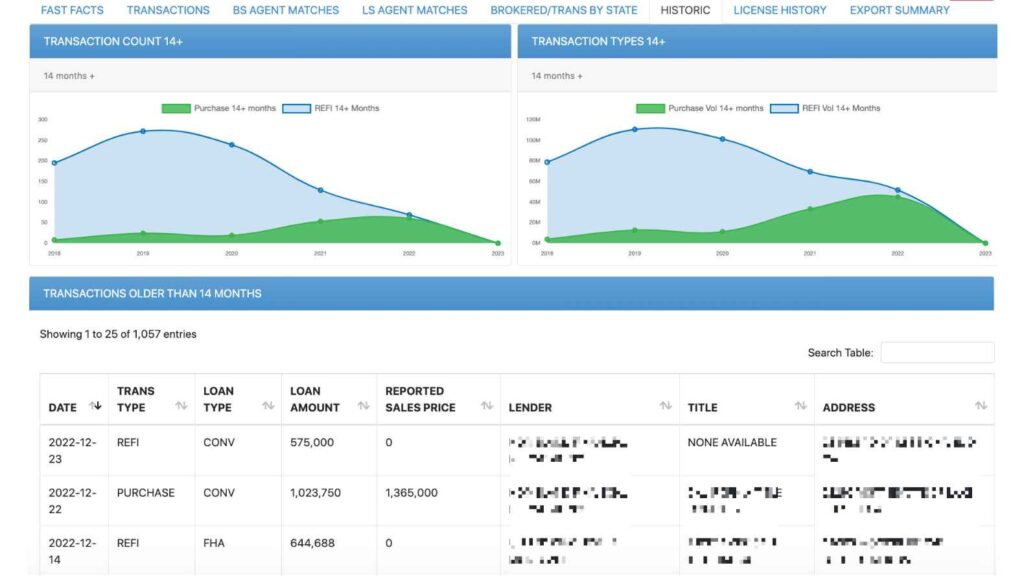

Another good data trend to be able to access is “Identify Rising Stars”. Through this data, you are able to locate loan officers who are trending up over the past 6 months. This way, you can look to recruit them before they become an entrenched superstar performer at their current organization. This is like building a sports team by scouting rookies whose performances are trending upwards.

Analyzing your competitors’ loan officers’ production can provide valuable insights and help you identify potential new hires. This approach offers a pool of candidates who are already succeeding in the market. With the right tool, you’ll have access to competitor lender office metrics and those for loan officers employed by them. You can view all the same types of loan officer KPIs we’ve referenced including:

The best loan officer databases and data guidance systems like MMI provide a direct connection to your recruitment CRM. This allows you to do performance analysis in your database. And then seamlessly push your top targeted loan officer candidate records to your CRM platform for loan officer recruiting. A CRM like Bonzo works perfectly in this type of situation. It allows you to move loan officer candidates from your database to the CRM and then run campaigns to your targets.

Continuously measure the success of your recruitment efforts and optimize your strategy accordingly. To understand where to improve your loan officer recruitment process, evaluate the performance of your loan officers on a regular basis. This can be done annually or semi-annually – or in real time. Then look at the KPIs you used to determine their expected performance and where there might be discrepancies. You’ll check the data you were looking at in your recruiting evaluation against current results. As part of your development and retention program, make sure to address and help any loan officers that require support.

Access unique transaction data to help gauge loan officer production and performance.

Internal referrals often yield excellent candidates who align with your company culture and values. Networking within your organization or professional circle can provide insights into loan officers actively seeking new opportunities.

Having someone you trust recommend a loan officer to you is incredibly valuable and important to have as part of your loan officer recruiting strategy. Also, you can get the inside scoop on loan officers that your colleagues may know to be looking for a new opportunity. And they may even be interested in working for your organization. Internal referrals are worth their weight in gold and this is always a great place to start as you look to recruit new loan officers.

Second-hand references, self-reported employment history, and online searches help you gather information about potential candidates. By cross-referencing data from multiple sources, you can create a comprehensive profile of a loan officer’s skills and experiences.

When you’re looking to put together a comprehensive profile of a loan officer candidate to recruit, perform research and due diligence. Some of this takes the form of internet sleuthing by looking at LinkedIn profiles and reading a candidate’s self-reported employment history. You can then review any second-hand references that you can find online. You can also leverage Consumer Access to look up employment history. Performing a Google search can uncover plenty of websites with information that will help to confirm or negate a candidate’s information. This includes employment history, references and referrals, ratings and rankings, and other helpful information.

It’s easier and more convenient to have a data guidance system like MMI in place with this data at your fingertips. You can then quickly confirm and vet background information and any numbers that you are seeing.

As we’ve noted, loan officer databases and data guidance systems offer performance data that can guide your recruitment efforts. Platforms like MMI provide the advantage of data-driven decision-making. This allows you to identify, prioritize, and engage with top candidates effectively. Our article about tools to recruit top loan officers is a great resource to learn more about this.

This data can be looked at in context with any of the other tactics and tools we’re recommending. The types of information gleaned from internal referrals, internet searches, and other impressions you have are helpful and directional. Especially as it relates to developing a comprehensive profile for a loan officer. Having hard metrics on performance like loan volume, loan value, average closing time, and agent relationships are invaluable. These data really help you understand a candidate’s immediate potential value to your organization.

Integrating your loan officer data platform or guidance system with your recruitment CRM streamlines your workflow. It ensures that all pertinent data is readily accessible within your CRM, enabling efficient communication and management of potential candidates. You can make manual lists and rig together a number of tools to try and achieve the same outcomes. But having a CRM like Bonzo streamlines all of this work.

A CRM will give you a very organized and comprehensive look on a candidate-by-candidate basis. They allow you to track your activity with candidates with notes and calendars, and integrate with email and SMS systems. This way you can send and also automatically keep track of these communications and any responses in a single record. To expand on that, most CRMs also have marketing automation tools built into their platforms so that you are able to build and deliver more complicated campaigns. For loan officer recruiting, these can be sent to single or multiple loan officers as you pursue talent.

Maintaining relationships with loan officers in your local area is essential for successful recruitment. Attend local events, engage in networking opportunities, and use data from your guidance system to identify potential outreach points. By building these relationships, you establish a foundation for fruitful recruitment conversations.

A data guidance system is valuable because it provides you with actual loan officer performance metrics. But when you have a personal relationship with a loan officer you know how they interact and engage with people, their likes and dislikes about work, and what motivates them. This gives you a sense of if you can trust a person.

Really knowing a person and what makes them tick can help you decide early on in the recruiting process whether it’s someone you’d be keen on hiring. And it can also help later on in the process if it comes down to selecting one person versus another. Or whether or not to choose and make an offer to the person you know better and are more comfortable with. It will also inform when not to hire a candidate you know better. This is because you are aware of things about them and their style that would not benefit your organization.

Inform your recruitment process with insight into historic loan officer transaction data.

Loan officer recruiting is a strategic endeavor that requires careful planning and effective tools. To get started on the road to success:

Choose a tool that provides you with the data, features and functionality that will best support your business. You want something to support your needs now and also grow with your business as you continue to evolve. You need a tool that is going to help you understand the metrics for a loan officer that drive the bottom line. A data guidance system like MMI will provide you with these numbers that matter. These data include information like loan volume, loan value, average processing time, agent relationships, and preferred geographic coverage. Armed with this information, your recruiting team can feel confident that they have the most solid, foundational understanding of loan officer performance metrics. This is critical as they engage and move further through the recruitment process.

Use your database platform to identify your top candidates and then prioritize from there based on the metrics that are most important to you. You’ll do this while considering any relationship you already have with these individuals.

Create a prioritized list of those you’d like to speak with. And re-establish relationships: Reach out and have conversations with them. Utilize SMS, phone calls, email, local events, personal meetings and other opportunities to directly engage with your top candidates. You’ll want to utilize your recruitment CRM to help with these – one like Bonzo. With Bonzo, you are able to push loan officer contact records from your loan officer data tool directly into its CRM platform. You can then use Bonzo’s Campaign Builder allowing you to perform personal, customized outreach at scale. The Campaign function allows you to automate your outreach and its timing while leveraging calls, texts and emails.

In a dynamic mortgage industry, recruiting and retaining top loan officers will position your company for growth and success. You’ll be able to anticipate capturing a larger share of the market. Embrace data-driven tools and strategies to make informed decisions and secure the top talent that will drive your organization’s success. Our webinar about how to search, identify and target loan officers helps to provide further guidance and valuable insights about how a data guidance system can help with loan officer recruitment.

Request a demo to see how MMI’s LO production data can supercharge your recruiting efforts.