Recruiting and retaining top-notch loan officers (LOs) is a mission-critical task for any mortgage lending organization. By using tools like loan officer production lookup and NMLS number lookup, you can find and hire top producers.

In this article, we will explain why loan officer production lookup matters, highlight key performance metrics, and share actionable steps to help you evaluate LOs more effectively.

Recruiting a great LO not only increases revenue from origination and closing fees, but also enhances the borrower experience. These factors provide you with a competitive advantage in the market.

Industry-wide statistics underscore the importance of the ongoing recruiting process. According to MMI’s data, the average LO turnover rate in 2024 was 25%— a testament to the constant flux in this profession.

Furthermore, LOs vary in their productivity levels. MMI’s data reveals that the top 50% of LOs averaged 12 deals and $3.7M in revenue in 2024. The top 25% averaged 32 deals and $10.6M the same year. Therefore, identifying and recruiting top LOs can significantly impact your revenue stream.

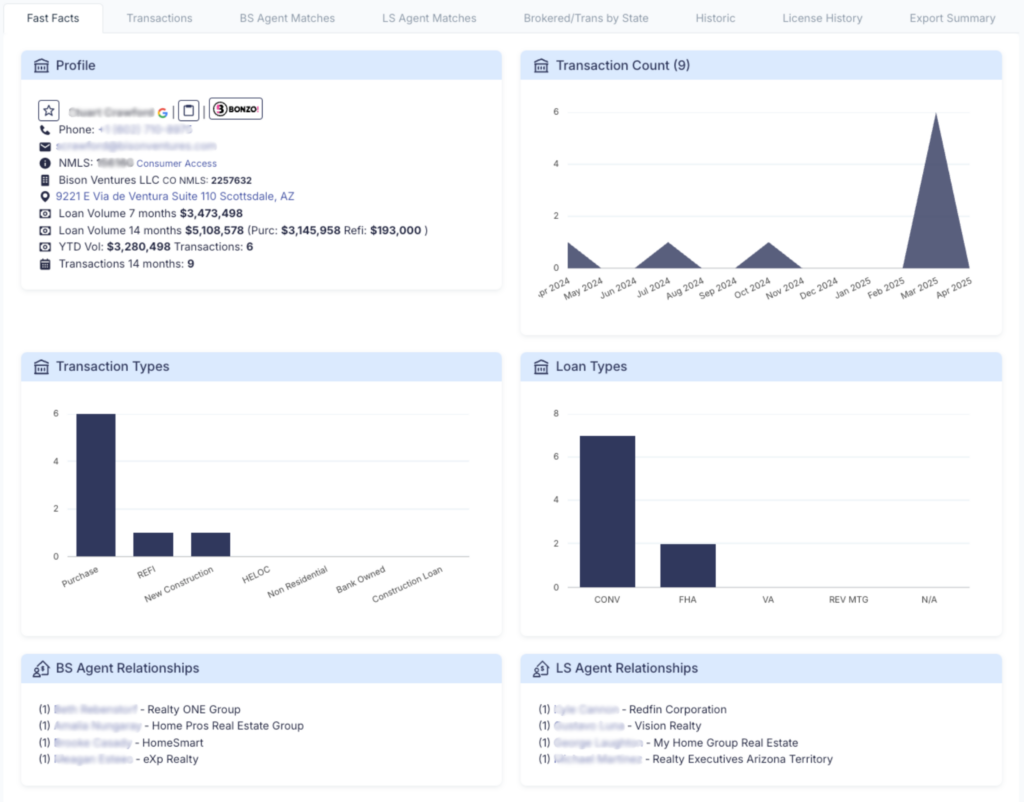

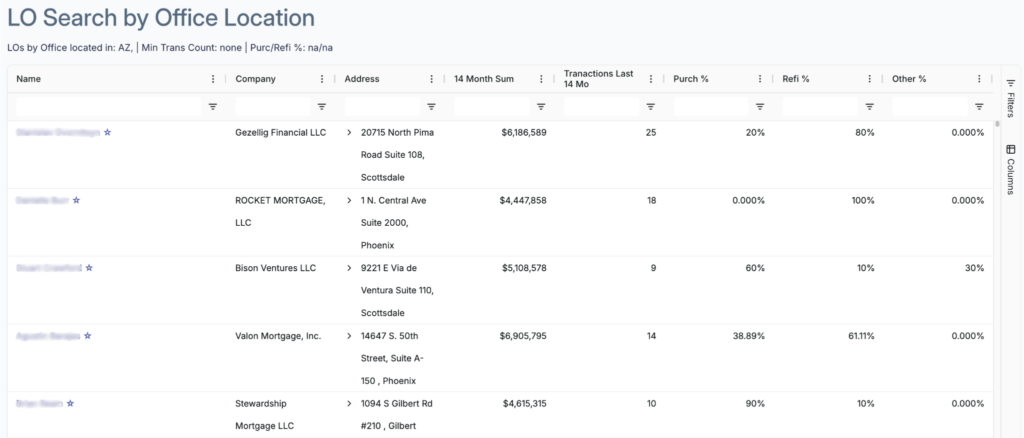

With MMI’s LO Quick Profile, you’ll get real-time mortgage intelligence to make smarter recruiting decisions—fast.

When evaluating LOs during the mortgage loan officer recruiting process, focus on metrics related to productivity and efficiency. Key metrics to examine in your loan officer production lookup include:

Our article on the best loan officer performance metrics will help you know what to look for.

Some of this data is available through Consumer Access. To get better information on loan officer productivity, use a more advanced loan officer database.

You can also try a data guidance system like MMI. This will help you find top candidates and access more metrics. Our post on tools to recruit top loan officers is a good place to begin.

Here’s a simple action plan to help mortgage companies find loan officer production when hiring potential candidates.

As you start or continue your journey to recruit mortgage loan officers, consider watching our webinar. It offers helpful advice on how to search for, identify, and target loan officers.

You can also request a demo of MMI to get an in-depth look at our tools. These resources will provide you with invaluable insights and support in your recruitment efforts to build a high-performing LO team.

In conclusion, loan officers play a pivotal role in the success of a mortgage lending organization.

As you hire new team members, you should check their productivity often. This will help your business grow while staying competitive and increasing revenue.

By following the action plan in this blog post and using data-driven tools, you can help your organization. This will ensure you evaluate and recruit the best LOs. You will always have a strong group of top LOs ready to succeed in a changing market.