Why Settle for Less When You Can Have It All—Or Just What You Need?

Disconnected tools waste time and lose deals. Some platforms give you data without action, alerts without follow-up, CRMs without intelligence. Our tools comprise a comprehensive mortgage technology platform – for lending professionals and soon for consumers!

MMI + Bonzo + MonitorBase & Pathways Home (coming soon!) lets you choose what you need: the full suite for maximum growth, the right mix for your workflow and cutting-edge insights for your borrowers. Our tools work together—or with what you already use—so you see results from day one.

Find the Right Opportunities

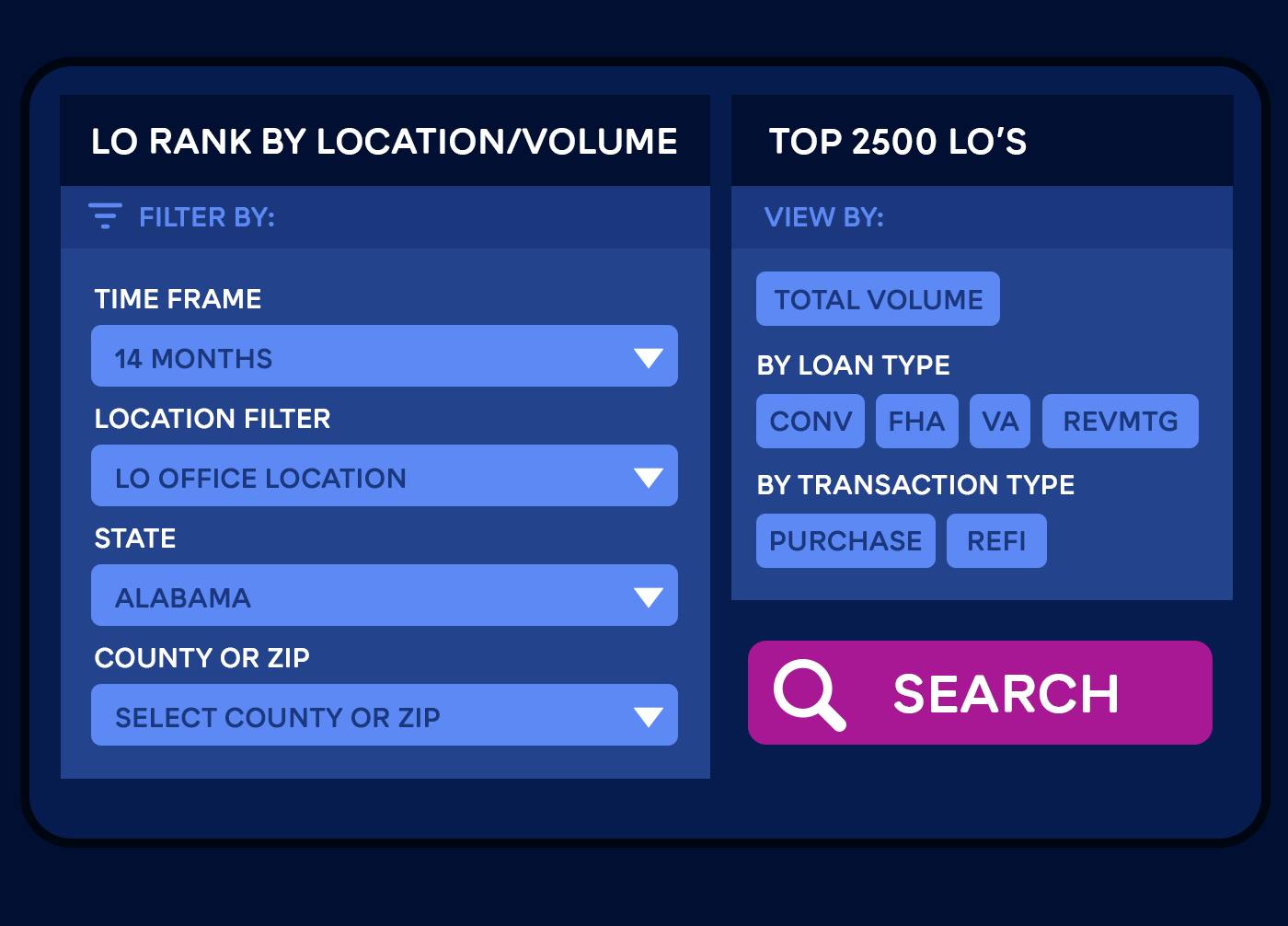

MMI is the data intelligence engine of our all-in-one mortgage technology platform, working seamlessly alongside Bonzo and MonitorBase to power smarter growth. More than 450 enterprise customers use MMI’s services and products, including half of the top 100 lenders in the U.S. Other platforms scrape data from limited sources, leaving gaps in your market strategy. MMI covers over 95% of U.S. mortgage transactions, offering the most comprehensive and accurate loan officer, lender, and real estate agent production data available.

Now as part of a comprehensive mortgage technology platform, MMI delivers the data insights with

Works best with: Bonzo for seamless outreach to top referral partners AND/OR MonitorBase to act on borrower insights before competitors.

Convert More Leads Without the Manual Work

Bonzo is the engagement engine of our all-in-one mortgage technology platform, working seamlessly with MMI and MonitorBase to help lenders build stronger relationships and drive growth.

Most CRMs require manual follow-up, disconnected workflows, and limited automation. Bonzo changes the game with a fully integrated, AI-powered engagement platform.

Works best with: MMI to optimize referral outreach AND/OR MonitorBase to automatically engage high-intent borrowers at the right moment.

Act Before Borrowers Even Start Shopping

MonitorBase is the borrower intelligence engine of our all-in-one mortgage technology platform, working seamlessly with MMI and Bonzo to help lenders stay ahead of borrower intent and drive timely action.

While competitors rely on outdated or incomplete borrower data, MonitorBase provides real-time alerts based on credit behavior, mortgage readiness, and predictive analytics.

Works best with: MMI to align borrower alerts with market data AND/OR Bonzo to instantly engage warm leads through automated follow-up.

Pathways Home is a revolutionary consumer experience for homeowners. It connects borrowers to their home equity, real estate goals, financial outlook, and local experts—bridging the lender-consumer gap before, during, and after a transaction.

Stay top-of-mind with clients for years—not just months

Help borrowers explore their home equity and real estate options

Create lifetime loyalty through proactive guidance and trusted connections

Whether You Need All Three or Just Two (or… Just One)

Unlike other vendors that force you into rigid, disconnected tools, we offer a fully integrated ecosystem or the perfect standalone solution that works with your existing tech stack.

Other vendors make you juggle multiple tools, struggle with integrations, and deal with data silos. With MMI, Bonzo, and MonitorBase, you get results-driven solutions that works together—or with what you already have. And Pathways Home will soon allow your LOs to engender client loyalty through proactive guidance and trusted connections.

Why pay for multiple disconnected tools that create inefficiencies?

Whether you choose MMI, Bonzo, MonitorBase, Pathways Home (coming soon!) individually, in different combinations, or the full power of all four, our solutions are designed to help mortgage professionals find, engage, and convert more borrowers and referral partners with ease.

Take a demo today to see MMI and its complementary solutions for yourself.