Part 1 of 3 in the Refinance Retention Series

After all the effort, expense, and time it takes to close a loan, most lenders never see that borrower again when they’re ready to refinance.

If you’re in mortgage lending, you already know the grind of winning new business. But what often goes unnoticed — and costs lenders dearly — is how much business quietly slips out the back door.

The culprit? Refinance borrowers you’ve already worked hard to win.

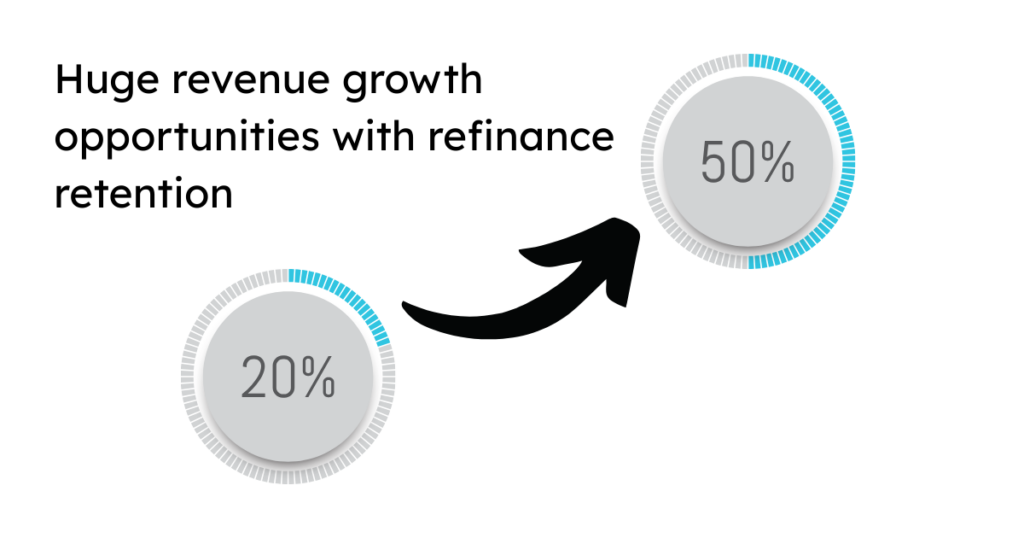

Across the industry, the average refinance retention rate hovers around just 20%. That means eight out of ten borrowers are refinancing somewhere else when the time comes — despite the relationship you’ve built.

Let that sink in.

After all the effort, time, and money it takes to close a loan, most lenders lose the repeat business that should be the easiest win on the table. It’s no wonder refinance borrower retention is quickly becoming one of the hottest priorities in lending circles.

Strong borrower relationships are your most valuable asset — retention starts with trust.

Retention is one of the most powerful — and most overlooked — levers for mortgage growth.

Here’s why this matters so much.

In other words, you’re sitting on a goldmine. But without the right refinance retention strategies for lenders, you’re leaving that gold for competitors to scoop up.

Retention isn’t just a back-office metric — it’s a multiplier for growth.

Improving retention from 20% to 50% isn’t just a metric shift — it’s a multimillion-dollar growth opportunity.

To put this in perspective, say you’re originating $1 billion in loans annually. If just 10% of those borrowers become refinance-ready each year, that’s $100 million in opportunity.

At a 20% refinance retention rate, you’re capturing $20 million. But raise that retention to 50%, and suddenly you’re bringing in $50 million — $30 million in extra volume, without spending an extra dime on lead generation.

That’s the magic of knowing how to increase refinance retention. It’s not just about holding onto customers — it’s about compounding revenue.

The challenge, of course, is execution.

Many lenders don’t have a system in place to know when borrowers are ready to refinance. Even if they do, outreach tends to be generic — a quarterly newsletter here, a mass email there — which doesn’t move the needle.

And the tech stack? Let’s be honest: it’s often a mess. Disconnected CRMs, marketing platforms, and LOS systems make it nearly impossible to act on insights in real time.

That’s why forward-thinking lenders are turning to refinance borrower retention solutions that combine borrower monitoring, data analytics, and automated engagement.

The right tools turn today’s challenges into tomorrow’s wins — now’s the time to act.

The market has changed.

Borrowers are more informed, competitors are more aggressive, and technology has raised the bar. Improving your refinance retention rate is no longer a nice-to-have — it’s make-or-break.

We’re seeing more lenders embrace refinance retention strategies that use predictive analytics and automation to spot opportunities early and deliver timely, relevant outreach. These tools make it possible to personalize communication, reduce churn, and act before the borrower even shops the market.

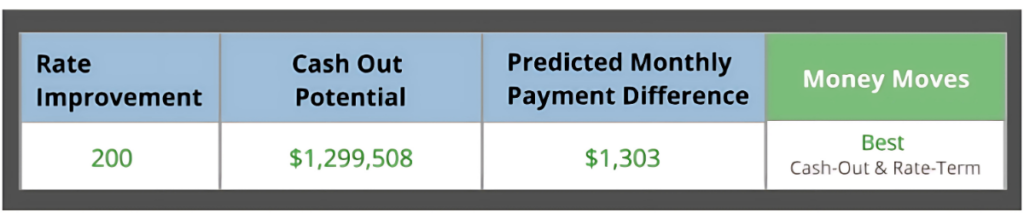

Tools like MMI’s Refinder combine predictive borrower insights, real-time monitoring, and automated outreach to help lenders retain up to 50% of borrowers they’re currently losing. Check out what you’re missing out on by visiting one of MMI’s Personalized Refinder Videos:

Watch your Individual Refinder Video here.

Watch your Company’s Refinder Video here.

The payoff of getting this right isn’t just bigger numbers — it’s stronger relationships.

By focusing on refinance retention rate, lenders can:

Imagine lifting your refinance retention rate from 20% to 50%. That’s not just a few more deals — it’s tens of millions of dollars and a stickier borrower base that’s less likely to wander when the next opportunity arises.

Here’s the bottom line: if you’re not measuring and improving your refinance retention rate, you’re almost certainly leaving money on the table.

The good news? You don’t need to overhaul your business overnight. Start by understanding where you stand, then explore how to increase refinance retention through better borrower monitoring, smarter outreach, and the right technology.

Because once you know your number, you can start changing it — and that’s when the real growth begins.

Check out Part Two in this blog series: “Where Refinance Retention Breaks Down — And How Smart Lenders Are Fixing It.” In the next post, we’ll unpack the biggest points of failure in traditional refinance retention strategies — and how smart lenders are fixing them.