Part 2 of 3 in the Refinance Retention Series

In this post, we unpack where refinance borrower retention strategies most often fail — and reveal the key moves that set top-performing lenders apart.

Most lenders don’t realize how much opportunity they’re losing. On average, only about 20% of refinance borrower retention candidates stay with the same lender when it’s time to refinance — meaning 80% walk out the door.

This isn’t just about missed volume; it’s about lost lifetime value. Improving mortgage borrower retention from 20% to 50% doesn’t just capture more loans — it dramatically grows revenue without adding lead generation costs.

So why do so many lenders fall short on retention?

Without the echolocation skills of a bat or a data intelligence tool that spots refinance-ready clients for you, you’re left in the dark when opportunity is right in front of you.

The first challenge is visibility. Without borrower monitoring tools, lenders have no early warning when a borrower is preparing to refinance. By the time they find out, it’s often too late — the borrower has already started shopping or gone with a competitor.

The second problem is generic outreach. Even when lenders do engage, they often rely on mass emails or untargeted messaging that fails to connect. Today’s refinance borrower retention candidates expect timely, relevant communication that speaks to their unique situation — not a one-size-fits-all marketing blast.

Finally, disconnected technology stacks are a major obstacle. CRMs, loan origination systems, and marketing tools that don’t integrate make it nearly impossible for teams to coordinate outreach, track borrower journeys, and execute effective mortgage customer retention strategies.

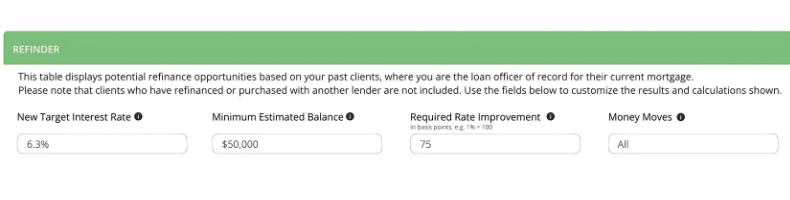

Spot Refi Opportunities Before They Slip Away. MMI’s Refinder tool helps loan officers boost refinance retention by 30–50% by identifying past clients who are primed for a better rate—based on your target thresholds and real-time data.

Leading lenders are addressing these gaps head-on.

They’re adopting predictive borrower monitoring tools that surface early signals like credit inquiries, equity growth, or key loan anniversaries. With these insights, they can identify refinance-ready borrowers before the competition does.

They’re also embracing automated, personalized outreach that moves beyond generic campaigns. For example, a borrower nearing a rate reset might get a customized offer, while a borrower with significant home equity might receive tailored HELOC options. This approach transforms how to improve mortgage borrower retention into a scalable, repeatable process.

And crucially, they’re investing in integrated tech platforms that unify CRM, marketing automation, and analytics — breaking down silos and making cross-team execution seamless.

Want to see how top lenders are transforming borrower retention? Platforms like MMI’s Refinder use predictive insights, live borrower monitoring, and smart automation to help lenders hold onto up to 50% more refinance borrowers.

See the opportunity for yourself:

Watch your Individual Refinder Video here.

Explore your Company’s Refinder Insights Video here.

The payoff for improving retention is significant.

Consider this: a lender originating $1 billion per year with a 20% retention rate is capturing just $20 million in refinance business. But increase that retention rate to 50%, and you’re suddenly pulling in $50 million — all without spending another dollar on marketing.

One national lender recently combined predictive monitoring with personalized outreach and saw a 15% increase in mortgage borrower retention over two quarters, delivering millions in new revenue and reducing churn dramatically.

She’s Not Guessing—She’s Monitoring. With real-time refinance signals on her screen, move beyond generic outreach and into segmented, automated borrower journeys based on real-time opportunities that actually convert.

For lenders ready to strengthen retention, here’s a proven roadmap:

Start by auditing your current retention process — where are you losing borrowers, and why?

Next, invest in borrower monitoring tools that surface refinance signals in real time. From there, upgrade your outreach strategy to move beyond generic emails to segmented, automated journeys.

Most importantly, bring your systems together. A unified platform that integrates CRM, marketing, and borrower intelligence is key to executing on refinance borrower retention strategies effectively.

The competition for borrower loyalty has never been tougher. But with the right tools and strategies, lenders can improve mortgage borrower retention, reduce churn, and turn retention into a major growth lever.

In part three of this series, “How to Increase Refinance Retention Rates: Strategies, Tools, and Results”, we’ll cover the specific technologies and success stories that are helping lenders double their retention rates — and transform their bottom line.