HMDA compliance can be challenging—learn how to navigate it effectively. Discover the tools and strategies for accurate HMDA data reporting.

Mortgage lending is driven by data. But not all data is created equal. For lenders, HMDA data offers something powerful: a standardized, public lens into your lending activity, practices, and impact. It’s not just a compliance requirement—it’s a roadmap for improving transparency, reaching underserved borrowers, and identifying opportunity.

When paired with smart technology, like MMI’s Social Impact dashboards, HMDA data can transform how lenders evaluate performance, monitor outreach, and drive more equitable lending decisions.

If you’ve ever wondered what is HMDA data, here’s the answer: it’s the set of loan-level data that certain lenders must collect and report each year under the Home Mortgage Disclosure Act. This includes information about mortgage applications, borrower demographics, loan outcomes, and property details.

Whether the loan was approved, denied, withdrawn, or incomplete—it all gets reported. The goal is to shine a light on mortgage lending activity across the country.

While originally designed to combat discriminatory practices, HMDA mortgage data now plays a broader role. It helps lenders evaluate trends, track performance, identify gaps in service, and demonstrate compliance with fair lending laws and Community Reinvestment Act (CRA) goals.

For forward-thinking lenders, HMDA data isn’t just about oversight—it’s about using insight to grow.

There are dozens of fields collected through HMDA, but some of the most critical HMDA data points include:

Each field provides deeper visibility into how—and where—you’re lending.

The HMDA data dictionary defines every required field in the dataset: how it’s collected, how it should be formatted, and what each code or value means. Lenders must follow these definitions precisely. Inconsistent or incorrect submissions can lead to public corrections, fines, or red flags with regulators.

Staying aligned with the data dictionary is essential to ensuring HMDA data accuracy.

Once submitted, HMDA data becomes publicly available. This public mortgage data is used by regulators, advocacy groups, journalists, and researchers to evaluate how well lenders are meeting the needs of various communities.

It also allows lenders to compare themselves to peers in similar markets, examine borrower trends, and spot emerging risks or gaps.

Institutions can download raw data from official government portals, but the real power comes when the data is translated into insight.

That’s where platforms like MMI come in.

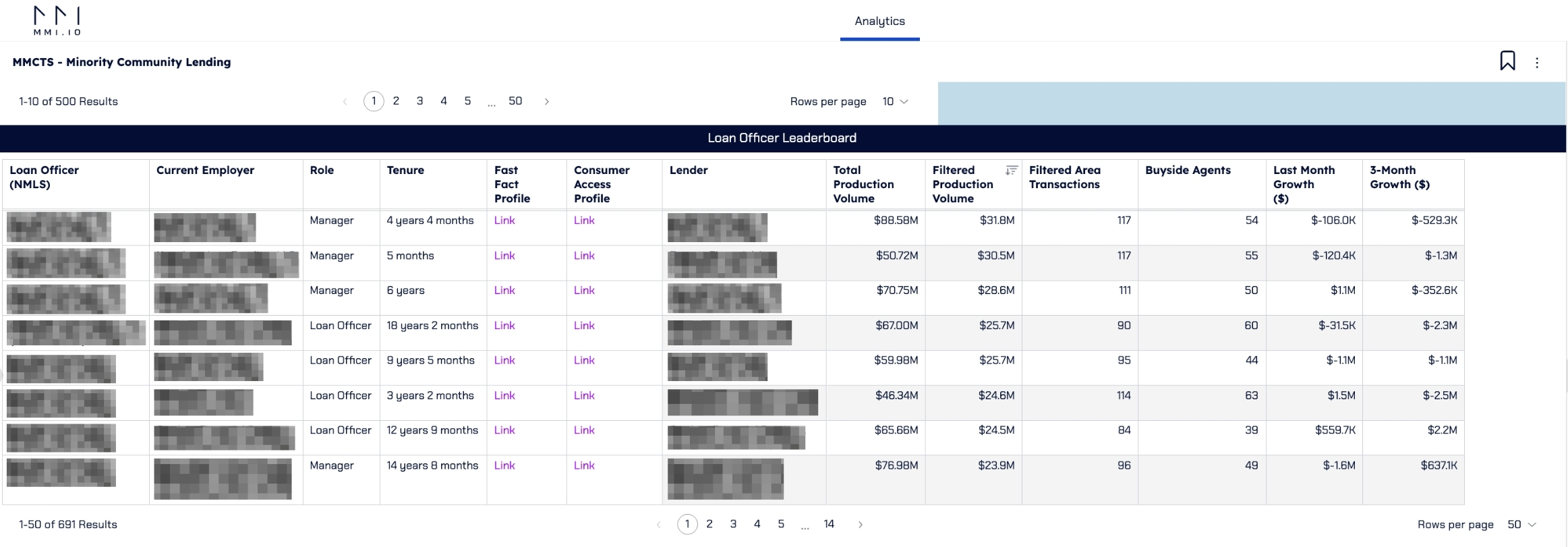

MMI’s suite of Social Impact dashboards provide your organization with up-to-date transactions that allow you to quickly identify real estate agents, loan officers, and third-party origination partners that are producing in HMDA designated underserved census tracts.

With this visibility, lenders can:

If your institution meets certain thresholds—typically based on asset size, number of originated home loans, and location—you’re required to report HMDA data annually. This includes collecting information during the calendar year and submitting it by March 1 of the following year.

The requirements apply to banks, credit unions, and some non-depository lenders depending on their volume and business type.

Many institutions run into common roadblocks, including:

Each of these can trigger audit flags, fines, or reputational damage if not addressed early.

MMI’s compliance features help reduce these issues by identifying gaps and validating fields before submission.

Submitting clean, complete HMDA loan data does more than satisfy regulators—it improves internal performance reporting and decision-making. Mistakes in loan purpose, income, or census tract classification can misrepresent your impact and hide areas of need.

HMDA data accuracy is especially critical when institutions use the data to evaluate CRA performance or demonstrate outreach in diverse or underserved communities.

To maintain strong HMDA data integrity, institutions should consider:

MMI’s dashboards are built with these practices in mind—offering compliance safeguards that also support strategic planning.

HMDA data isn’t just a filing requirement—it’s a strategic asset when used correctly. It helps lenders uncover opportunity, protect against risk, and demonstrate their commitment to fair, transparent lending.

Whether you’re benchmarking performance, strengthening compliance, or growing into new markets, the insights inside HMDA data can move your institution forward. And with MMI’s Social Impact tools, accessing those insights is easier—and more actionable—than ever.

Want to see who’s making a real impact in underserved markets?

MMI’s Social Impact dashboards help you instantly identify top-performing agents, LOs, and partners driving production in underserved census tracts.

Request a demo today and start turning insight into action.

Read about The Majority Minority Census Tract in our blog post, “The Majority Minority Census Tract: Supporting Growth and Opportunity in Underserved Areas”