Finding and keeping the right loan officers is one of the most important jobs for any mortgage company. Good loan officers bring in steady business and often have strong referral partners that grow a lender’s reach.

Finding and keeping the right loan officers is one of the most important jobs for any mortgage company. Good loan officers bring in steady business and often have strong referral partners that grow a lender’s reach.

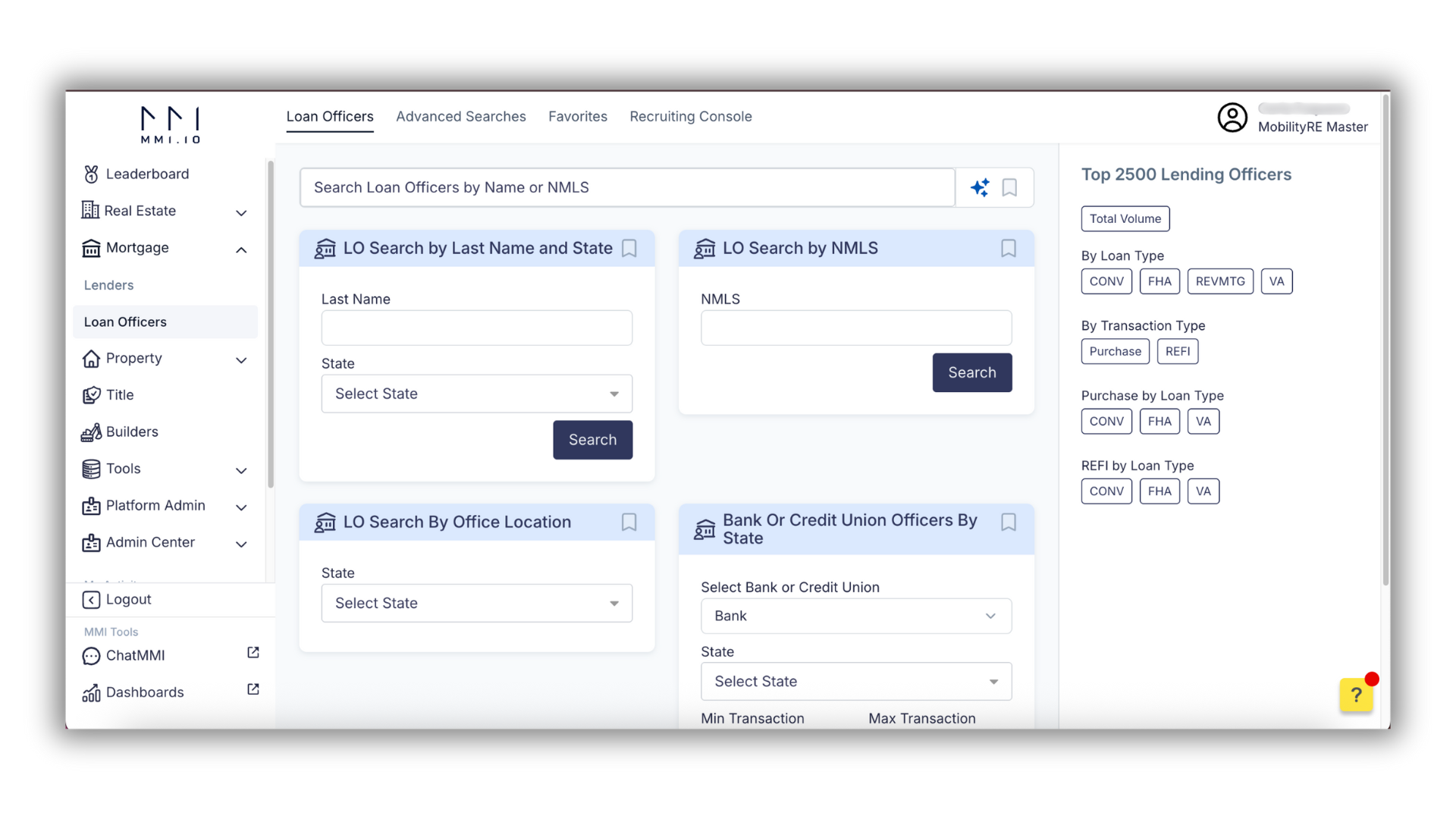

But spotting the right people isn’t always easy. Across the United States, there are thousands of lenders and loan officers. Recruiters can’t rely only on guesswork or word-of-mouth. They need clear data that shows who is performing, where they’re working, and how much business they’re bringing in.

That’s where a mortgage lender database helps. MMI’s database gives recruiters one place to see the information they need to find top producers, understand competitor activity, and build better recruiting strategies.

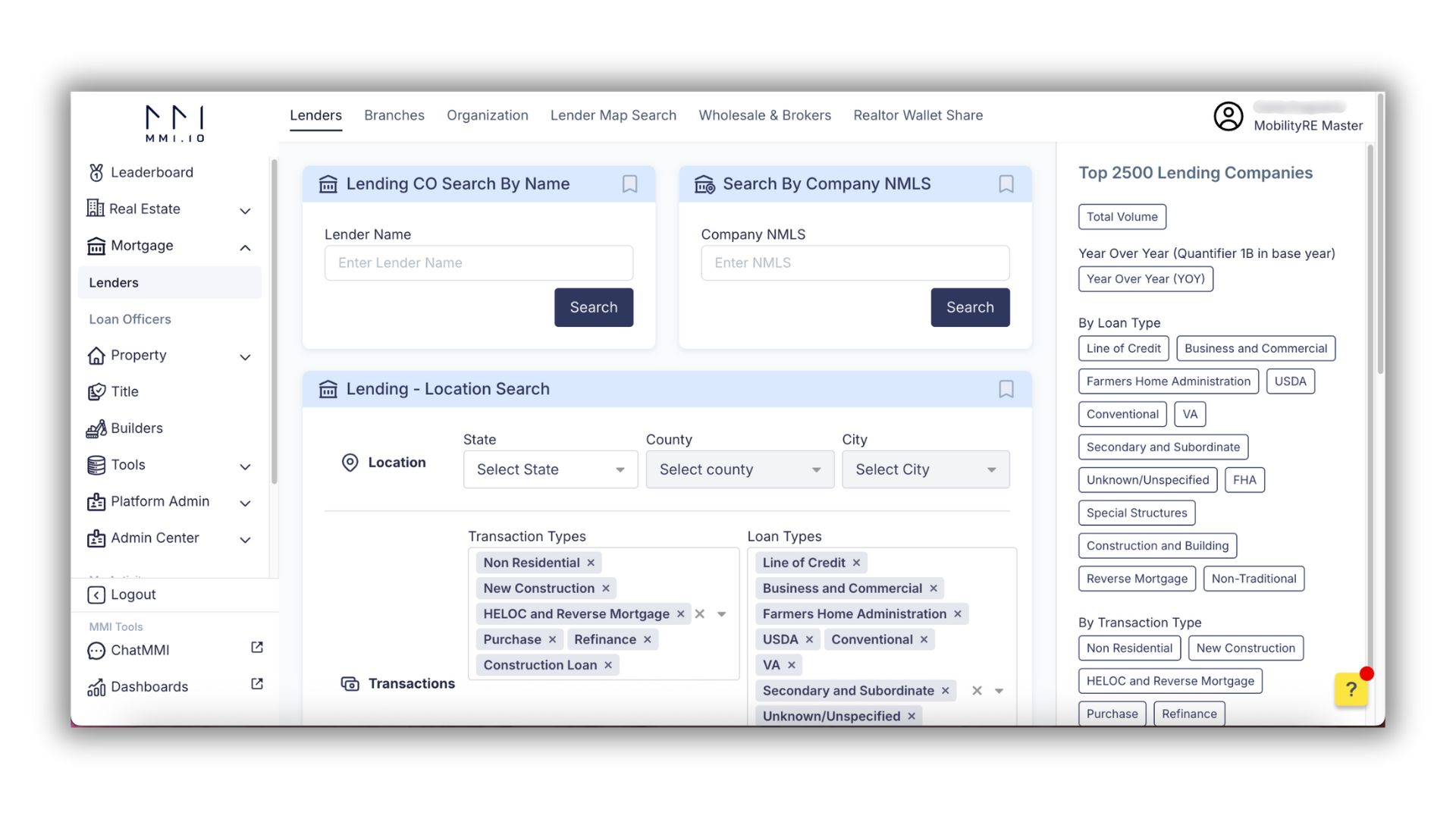

Filter searches by geography, loan type, or transaction type to find the right targets.

A mortgage lender database is a single tool that gathers important details about mortgage service providers, lenders, branches, and loan officers. Instead of juggling reports and spreadsheets, recruiters can open one platform and see the numbers that matter.

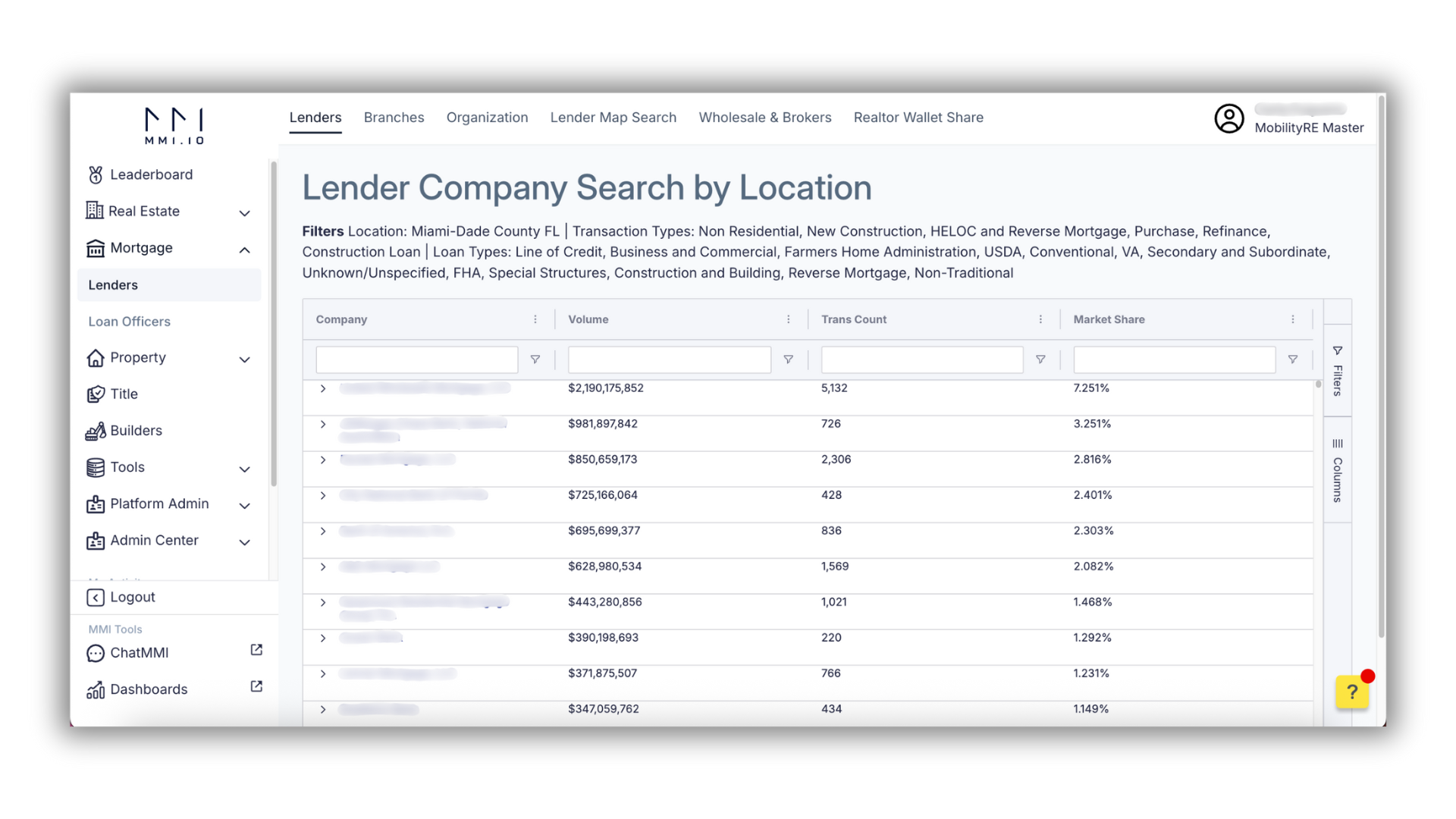

Recruiters often compete in local markets. A database makes it simple to review local mortgage lenders, see which companies are active, and find the loan officers driving that growth.

When recruiting in the home purchase or refinance space, being able to find the strongest residential mortgage lenders is key. A database shows which companies and officers are doing the most business so recruiters can focus on the right people.

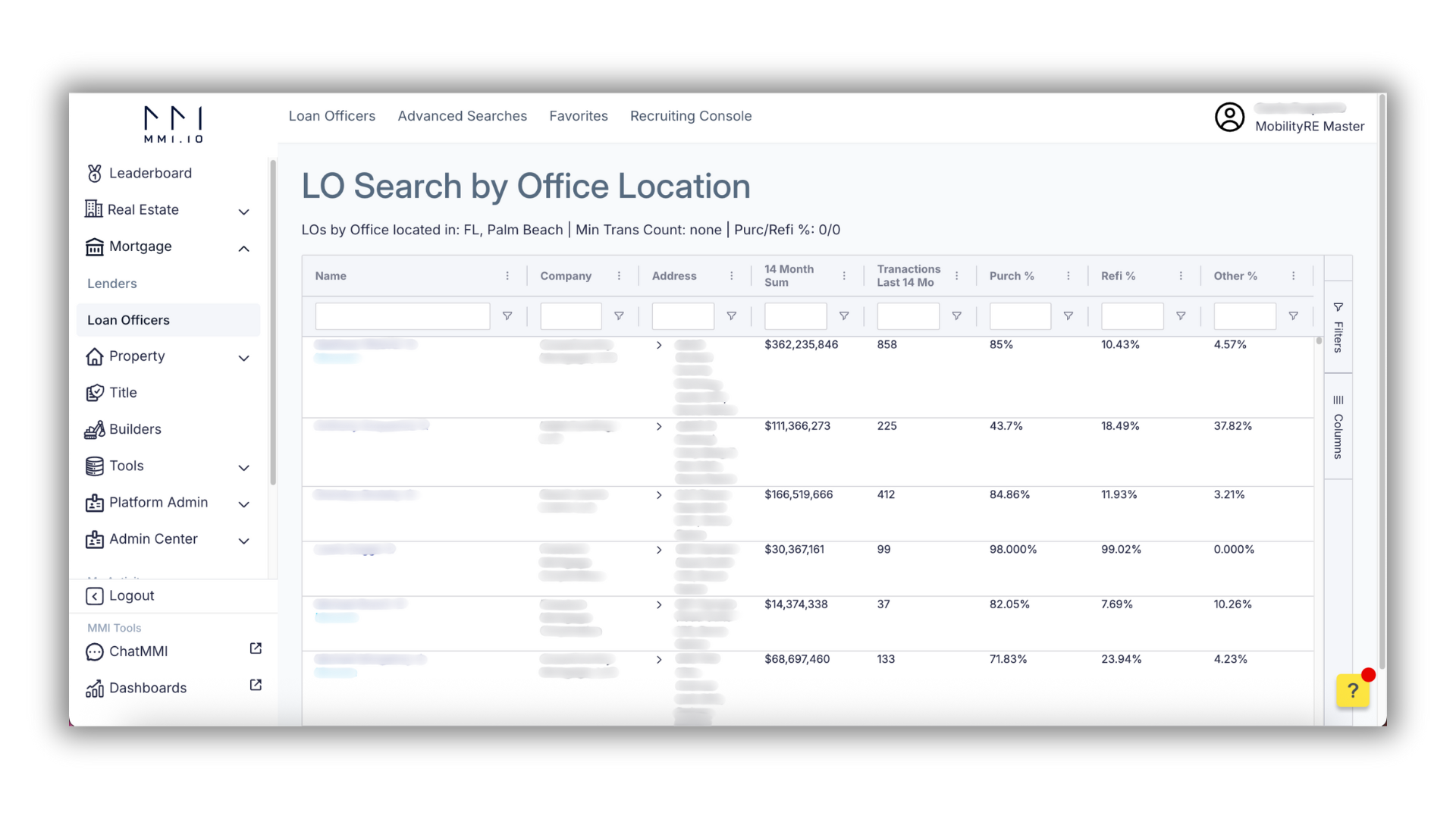

Drill down into loan officer production by office location.

Recruiters don’t need to pull together reports from different places. A mortgage lender database puts it all in one spot—loan volume, loan types, and officer activity.

With a database, recruiters can look at different mortgage service providers and their loan officers side by side. They can compare things like number of loans closed, total loan volume, and where each officer is active. This helps recruiters decide who might be a good fit.

Mortgage lender reviews give part of the story, but they usually focus on customer service. Recruiters need more detail. A database shows production history and referral relationships, helping recruiters see the full picture of a candidate’s value.

MMI makes it easy to search lenders by location and view their market share.

Recruiters can filter a database to find exactly what they need—whether that’s by market, branch, or product type. This makes it easy to zero in on loan officers and teams that match their recruiting goals.

Databases show more than loan counts. Recruiters can see:

This helps recruiters spot officers who not only bring in business but also have strong networks that could boost their company.

By reviewing the data, recruiters can see which loan officers are doing well, how much business they’re bringing in, and where there are gaps. This gives recruiters the chance to make targeted offers to the right people.

Many databases are just lists. MMI goes further by turning that information into clear recruiting insights.

Markets move fast. MMI keeps data fresh so recruiters always see current numbers, not outdated reports.

Search for individual loan officers by name, NMLS, or location to see production performance.

MMI doesn’t stop at lender-level data. It shows performance down to the individual loan officer. Recruiters can see exactly who is closing loans and how much they’re producing.

Top loan officers often bring strong referral relationships. MMI shows these connections, so recruiters can see which real estate agents and partners a loan officer works with.

By using MMI’s performance and relationship data, recruiters can target the right producers, make smarter hires, and create stronger retention strategies. It’s not just about finding people—it’s about keeping them and helping them grow.

A mortgage lender database is one of the most valuable tools for recruiters. It helps you spot local mortgage lenders that are performing well, review residential mortgage lenders for their market impact, and compare a wide range of mortgage service providers all in one place.

MMI’s database takes this to the next level. With current updates, loan officer production data, and referral relationship insights, it gives recruiters the confidence to hire and retain the right people.

If you’re ready to strengthen your recruiting strategy, MMI’s Mortgage Lender Database is the tool to help you build stronger teams and grow your market share.