Mortgage lending has never been more competitive—or more complex. Between margin compression, fluctuating rates, and recruiting challenges, lenders can’t afford to make decisions based on outdated reports or incomplete data. Yet many still do.

Mortgage lending has never been more competitive—or more complex. Between margin compression, fluctuating rates, and recruiting challenges, lenders can’t afford to make decisions based on outdated reports or incomplete data. Yet many still do.

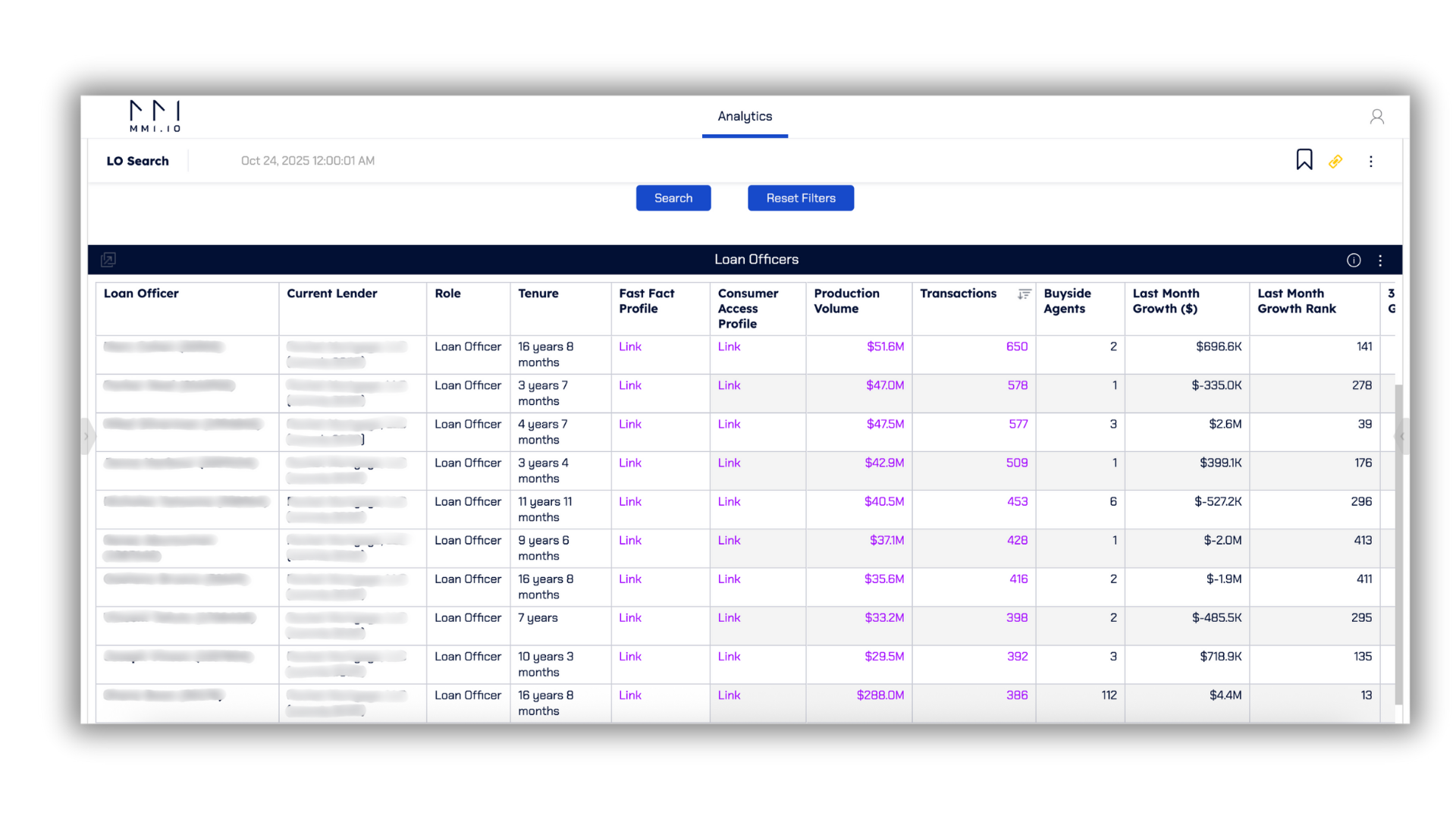

Teams rely on siloed LOS or CRM reports that tell only part of the story. You may know how many loans you closed last quarter, but not which loan officers are outperforming peers, which agent relationships drive the most volume, or where competitors are gaining share. You may have access to market data but no way to connect it to your own performance or outreach strategy.

That’s where modern mortgage business intelligence comes in. The next generation of mortgage BI moves beyond static dashboards and fragmented systems. It connects production, partner, borrower, and market data in one unified ecosystem—helping lenders see what’s happening, understand why, and act faster.

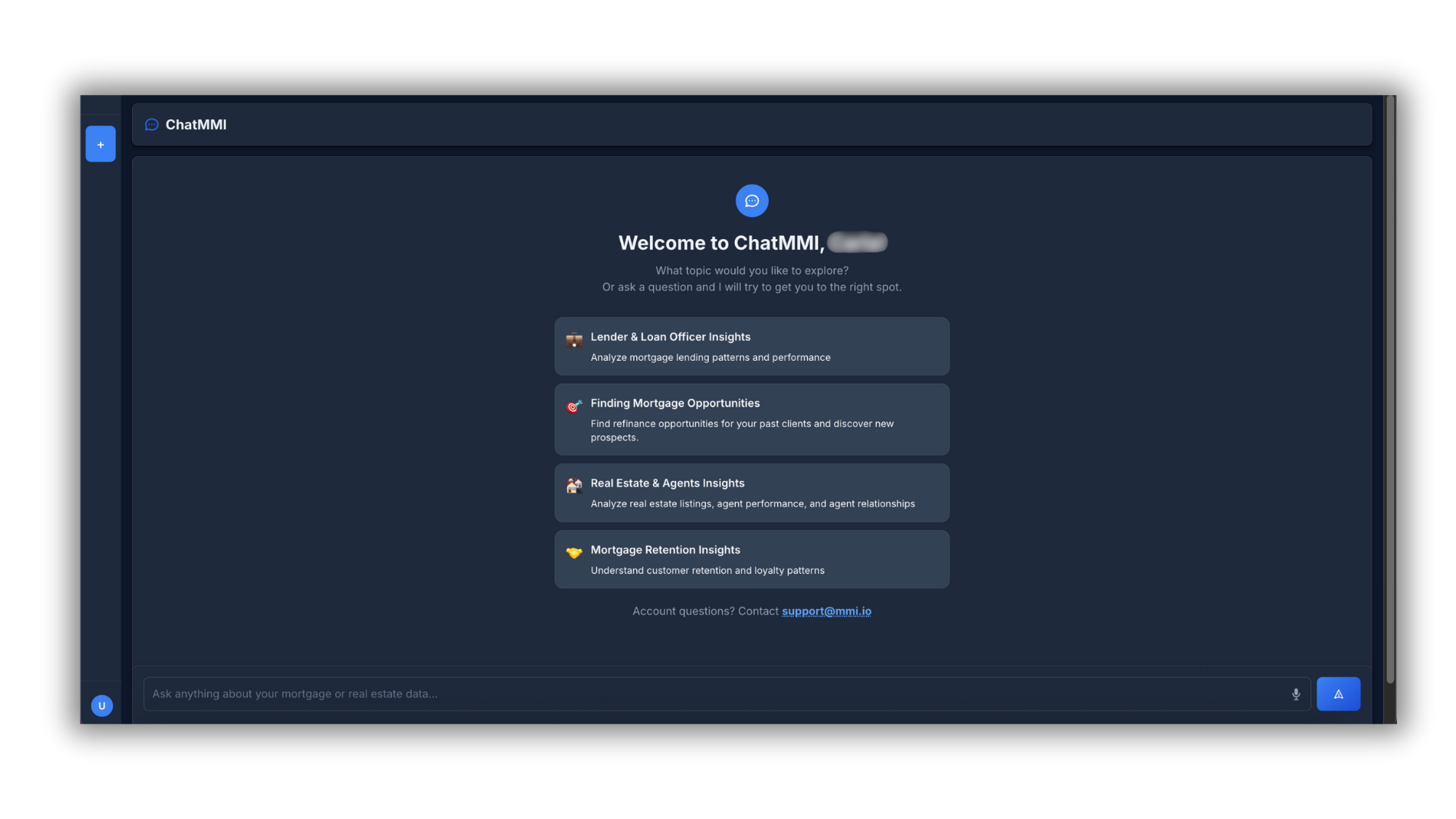

And now, thanks to ChatMMI, that process has become simpler, faster, and infinitely more conversational. With ChatMMI, you skip the dashboard entirely. Just ask a question—and get an answer in seconds.

At the center of this evolution is MMI, the industry leader in verified mortgage production and market intelligence. MMI provides the foundation for unified mortgage business intelligence, integrating with Bonzo and MonitorBase to transform static insight into real action. Bonzo automates personalized outreach to agents and loan officers, while MonitorBase identifies high-intent borrowers through predictive alerts. Together, these tools power the shift from data to decision—and ChatMMI adds the missing piece: speed. It’s the first conversational AI built for mortgage professionals, designed to turn dashboards into dialogue.

The term “business intelligence” gets used often, but not all BI is created equal. Traditional business intelligence is about reports and dashboards. It measures how fast files move, how much it costs to close a loan, and what your volume looked like last year. Valuable, yes—but limited. That’s operational reporting, not true intelligence.

True mortgage business intelligence combines internal performance data with external market, partner, and borrower insights to reveal not just what happened, but what to do next. It unifies the entire picture: your production performance, your agent network, and your borrower behavior—all aligned with what’s happening in the broader market. It’s not just analytics; it’s actionable awareness.

MMI provides that foundation with the industry’s most comprehensive, verified data—covering production history, market share, and referral ecosystems. You can see where your strongest branches are, who your top competitors are recruiting, and which agents are fueling your volume.

Bonzo then transforms that intelligence into communication, automating outreach sequences and campaigns to keep your brand visible with partners and prospects.

MonitorBase adds predictive borrower insights, alerting you when someone in your database lists their home, gains equity, or becomes eligible for a refinance.

ChatMMI, the newest addition to the MMI ecosystem, changes the game even further. Instead of clicking through dashboards or waiting on reports, you can simply ask, “Who switched lenders in the last 60 days near Dallas?” or “Which agents co-worked with our top producers last quarter?” and get ranked, exportable answers instantly. It’s conversational business intelligence—no filters, no dashboards, no friction.

Every effective BI strategy stands on three pillars—and now, a fourth.

You can’t improve what you can’t see. MMI delivers granular performance insights at the loan officer, branch, and company level, showing who’s producing, where, and how they compare across the market. Leadership teams use this data to identify top performers, support underperforming regions, and forecast trends before they hit.

Referrals are the lifeblood of mortgage production. MMI maps your agent and referral ecosystem to show which partnerships drive the most business. Bonzo takes that intelligence and automates personalized outreach—nurturing agents, re-engaging partners, and strengthening relationships without adding manual effort.

Markets move fast. MMI integrates market and demographic data with your internal performance, helping you identify underserved areas or competitors gaining ground. MonitorBase then alerts you when borrowers in your database show intent to move or refinance, allowing you to act before your competitors do.

This is where the next era begins. ChatMMI sits on top of MMI’s DataCenter and replaces dashboard dependency. Instead of logging into multiple systems, running filters, or building charts, users can ask a question in plain English and receive a direct, data-driven answer. “Which branches are underperforming compared to last year?” “Who are the top LOs by purchase volume within 25 miles of Denver?” The answer comes back instantly—and you can act on it, export it to Bonzo, or benchmark it against the market.

Dashboards show you what happened. ChatMMI tells you what to do next.

Dashboards are passive—they wait for you to click, filter, and interpret. ChatMMI is active—it anticipates, answers, and drives action. With ChatMMI, you can skip the clicks entirely:

“Show me our top recruits in Florida ranked by agent overlap.” Done.

“Find PMI-drop candidates in our database.” Done.

“Who’s co-working with our agents but not in our system?” Done.

Other so-called “AI” tools are just glorified filters—search-and-export utilities that look smart until you pull back the curtain. It’s the Scarecrow in a new hat: all show, no reasoning. ChatMMI, on the other hand, uses large-language-model reasoning built specifically around MMI’s verified mortgage data. That means it understands your question, interprets the context, and generates a true, actionable response—not just another list.

Once you have MMI, Bonzo, MonitorBase, and ChatMMI working together, business intelligence becomes business acceleration. Here are five high-impact ways lenders are using this ecosystem today.

Recruiting is data science now. With MMI, you can filter by geography, loan mix, or agent network to pinpoint loan officers who align with your goals. ChatMMI makes it faster—just ask, “Who are the top-producing LOs within 50 miles that share agents with our team?” Bonzo then automates your first outreach sequence. No manual lists. No guesswork. Just faster conversations with qualified recruits.

Not all agent relationships are equal. MMI identifies which partners generate consistent volume and which ones have untapped potential. Bonzo automates outreach with personalized updates, event invitations, or local market snapshots. ChatMMI lets you surface those insights on demand—“Which agents have closed three or more loans with us this quarter?”—and act on them instantly.

Branch managers can’t coach blind. MMI’s dashboards benchmark production, pull-through, and market share by branch. With ChatMMI, those insights become immediate. “Show me the branches with the lowest Q3 pull-through rates.” The system returns ranked results you can export to leadership or route to Bonzo for performance-based follow-ups.

Retention is where profits live. MonitorBase detects when a borrower lists their home or reaches an equity milestone. MMI connects that borrower to their original LO and market trend. ChatMMI can deliver it conversationally: “Which borrowers in our pipeline are eligible for PMI drop or refinance?” Bonzo triggers the outreach. That’s intelligence turned into revenue in real time.

Growth starts with insight. MMI identifies rising markets and competitive shifts. ChatMMI can answer questions like, “Where are we losing share to competitors in Texas?” or “Which counties show the highest purchase growth this quarter?” Bonzo then automates outreach campaigns targeting those regions, while MonitorBase finds potential borrowers within them.

Lenders evaluating their BI strategy usually face three options: build, buy, or augment. Building in-house often sounds ideal but comes with hidden costs—months of setup, expensive maintenance, and limited scalability. You might end up with more dashboards, not more decisions.

Buying generic BI software solves some problems but rarely fits the mortgage industry’s unique structure. You still need to clean and connect data across LOS, CRM, and market sources.

Augmenting your existing systems with MMI—and now ChatMMI—gives you the best of both worlds. You get verified, mortgage-specific data and immediate, conversational access. ChatMMI eliminates 60–80% of dashboard dependency, reducing clicks, filters, and time-to-insight. It doesn’t replace your people—it frees them. Instead of waiting on reports, your team can ask and act in real time.

You don’t need another dashboard. You need an answer. ChatMMI delivers it.

Implementing BI doesn’t need to take a year or a massive IT team. Here’s a practical, 90-day roadmap that brings your business intelligence strategy to life.

Clarify what success looks like. Are you focused on recruiting, retention, or expansion? Choose two to three measurable outcomes. Use MMI to baseline your data and identify gaps in visibility.

Link your LOS and CRM data to MMI’s verified production and market intelligence. Enable ChatMMI for executives, recruiters, and branch managers so they can replace routine dashboard queries with conversational prompts. Integrate Bonzo to automate outreach and MonitorBase to add borrower alerts.

Launch dashboards and ChatMMI side by side. Encourage teams to use ChatMMI for real-time questions and Bonzo for follow-through. Benchmark KPIs like LO recruiting response rates, agent engagement, borrower recapture, and branch efficiency. By the end of 90 days, your teams will have faster answers, cleaner data, and measurable growth.

Data without action is decoration. The MMI ecosystem—powered by ChatMMI, Bonzo, and MonitorBase—turns intelligence into measurable growth. MMI gives you the verified data foundation. ChatMMI makes that data instantly accessible through natural conversation. Bonzo transforms insight into personalized engagement, and MonitorBase ensures you never miss a borrower opportunity.

Together, these tools redefine what mortgage business intelligence means. It’s not about dashboards—it’s about decisions. It’s not about reports—it’s about results. ChatMMI pushes the entire ecosystem forward by eliminating friction and replacing passive BI with active, conversational insight.

So, the next time someone shows you a flashy “AI dashboard,” ask one question:

Is it the real thing—or just a smoke machine behind a “Better” curtain?

Because pretty much anything is better than paying extra for basic recruiting features—even 1,000 flying monkeys banging on your window.

What is mortgage business intelligence?

It’s the integration of internal production, partner, borrower, and market data to give lenders a complete picture of performance and opportunity—made actionable through automation and conversational AI with ChatMMI.

Do I still need dashboards if I have ChatMMI?

Usually not. Most routine questions are faster with ChatMMI. Keep dashboards for occasional reporting, but let ChatMMI handle day-to-day analysis and decisioning.

How is ChatMMI different from other “AI” tools?

Other tools rely on search and filters. ChatMMI uses large-language-model reasoning trained on MMI’s verified mortgage dataset to understand context and deliver actionable answers you can export or act on instantly.

How do Bonzo and MonitorBase fit into this strategy?

MMI provides the data foundation. ChatMMI delivers the answers. Bonzo automates outreach to agents and LOs. MonitorBase adds predictive borrower alerts to strengthen retention. Together, they form the most complete mortgage intelligence system available.

What results can lenders expect in 90 days?

Faster recruiting cycles, stronger agent relationships, higher borrower retention, and dramatically reduced dashboard fatigue. Teams will make better decisions, faster, with less manual reporting and more measurable growth.

Ready to see it in action?

Schedule a live demo and experience how MMI, Bonzo, MonitorBase, and ChatMMI together redefine mortgage business intelligence.