For loan officers, building and nurturing strong relationships with real estate agents is paramount. Whether you’re connecting with existing agent partners, forging new relationships, or reaching out to past borrowers, your outreach strategies play a crucial role in your success.

Partnerships with real estate agents can be a goldmine for those looking to grow and expand their opportunities and closed business. Whether you’re connecting with existing agent partners, forging new relationships, or reaching out to past borrowers, your outreach strategies – as a loan officer marketing to realtors – play a crucial role in your success. In this blog post we’ll explore top agent partner outreach strategies that can help you thrive in the competitive real estate market.

There’s no one-size-fits-all approach to building meaningful referral partnerships with real estate agents and borrowers. By identifying how to market to realtors as a loan officer using the right strategies and tools, you can drive incredible success. And specifically, by performing the right research and leveraging the right data, you can pinpoint high-potential agents and timely borrowers. Throughout this process, it’s essential to focus on both retaining your existing network and expanding it by adding new partners.

There are many obstacles to building meaningful referral relationships with agents:

These are real estate agents you have already worked with. Nurturing these relationships is vital as they can continue to refer clients to you. With the right data, you can even hone in on relationships where there’s an opportunity to expand the percentage of business you’re receiving from specific agents.

Building connections with new agents is a way to expand your network and tap into fresh opportunities. Identifying the right agents and times to reach out and have informed, productive discussions is a challenge, but with the right tools it’s a viable strategy. Also, by layering in transaction-level data, loan officers can identify agents whose activity matches their goals and, therefore, would be a prime target for a referral relationship.

Reconnecting with past borrowers at the right time can lead to repeat and new business, especially when they introduce you to a real estate agent with whom you may not currently be working.

The numbers show that focusing on these outreach strategies can have a huge impact on your bottom line:

- 87% of borrowers make a lender decision based on a referral or existing relationship.

- When real estate agents refer clients, the client applies to the recommended lender 76% of the time.

- 39% of first-time buyers and 27% of repeat buyers use their Realtor as a referral source when choosing a lender

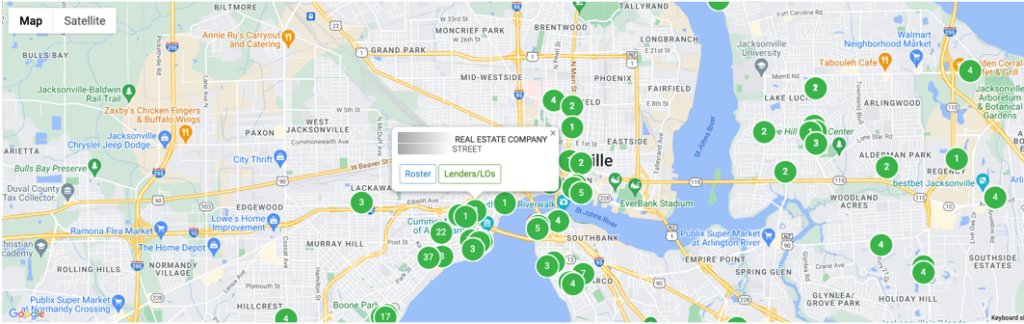

Using tools to identify agents and office in your geographic area can prove to be a productive strategy to grow your network.

Reconnecting with past buyside-listside agents you’ve worked with in the past, but with whom you do not have a current relationship, is a valuable strategy. You can leverage your successful past deals together to build trust and secure future referrals from these agents. Getting back in touch and revisiting success stories can help reestablish these relationships. Having access to the right data can help you rebuild these relationships by keeping you informed of deals they’re working on, deals just closed, percentage of their business they’re giving you, and other valuable information. With this insight, you can reach out at the perfect times with very relevant messaging to remind them of your past successes, strong ongoing partnership potential, and your sincere interest in their ongoing success.

With the right platform, you can identify new agents that will be the best partners for you. By researching local real estate agents, loan officers can identify successful agents in their area. To avoid wasted efforts, loan officers should also determine which agents are in need of a referral partner and which agents already have a solid referral relationship with a local loan officer. There are mortgage data platforms and resources readily available that loan officers can use for this research and outreach. Our post about tools to market to agent partners provides more insight into this.

It’s important to be on the lookout when an agent you’re tracking gets a new listing. Reaching out on the same day the listing is announced not only greatly increases your chances to earn business on this deal and any future deals from that agent, but it also shows potential partners that you’re a proactive teammate that can deliver real value to the relationship. Tools like MMI allow you to set up email alerts so you become aware of new listings right away.

By keeping an eye on when a property you’ve previously done a loan for hits the market, you’ll know that a past borrower is ready to make a move, giving you the opportunity to reach out and see if you can be of assistance. This also presents an opportunity to make an impression on a real estate agent and potential referral partner with whom you aren’t already working.

A hallmark of a successful referral relationship is when an agent is referring a majority of their “right fit” clients to you. But you could be missing out on receiving more of their business because they aren’t aware of the types of loans that you offer. To make sure you’re making the most of your referral partnerships, ensure that you have clear and open communication with your real estate agent partners so that they are fully aware of all the loan products you offer.

There are many tools that provide insight into the volume, types of loans, and value of business you’re getting from specific agents – and all the types of business they’re doing with other loan officers. Our article on measuring the value of your agent network is a good place to learn more about this.

As we’ve discussed, building referral partner relationships is difficult, but there are tools and technologies that can help you identify great partners. Having similar interests is a harbinger to a productive relationship. Partnering with an agent that works in your geographic area and focuses on a similar set of homeowners and/or properties ensures that you’ll continue to work within your area of expertise while expanding your business and network at the same time.

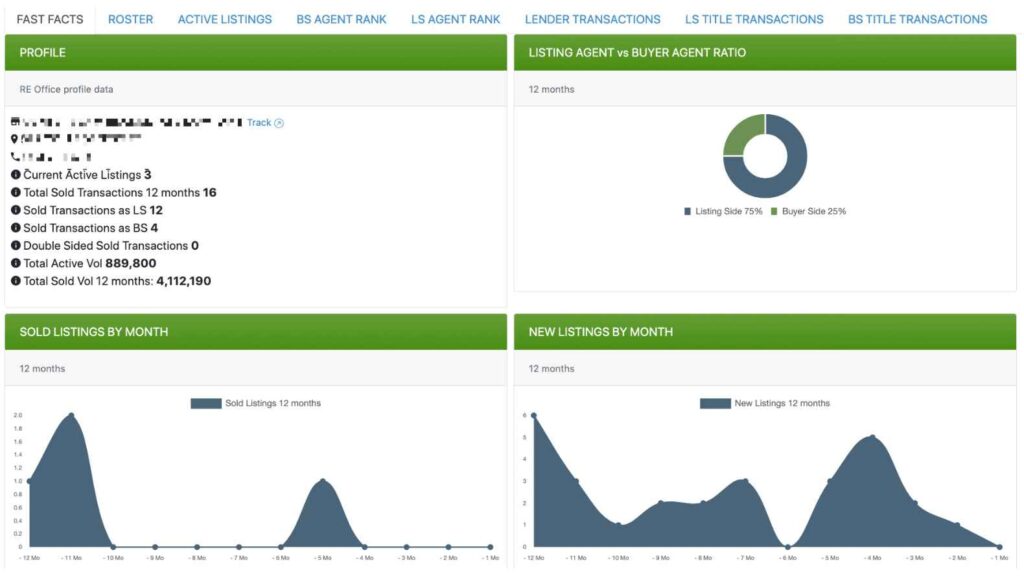

A good mortgage data solution will provide key insights into real estate offices and their core performance metrics.

Now that we’ve explored various loan officer marketing outreach strategies, it’s essential to take a structured approach to implement them effectively. Prioritize your approaches based on value, resources, and fit and follow a methodical outreach plan.

Start by evaluating the marketing outreach strategies you’re already using. Work with your team to identify what’s working and what needs improvement. It starts with having access to accurate data and information about real estate agents, and having insight into past borrowers is important too. Start by making a list of the strategies you are currently employing and the tools and technologies that drive them. By identifying holes in your overall approach, you can then begin to approach how you want to build a more robust plan.

Not all strategies will be equally effective for your business. Prioritize them based on their potential value, the resources you can allocate, and their fit with your goals. Look at the current strategies that are working; those that can be improved; and those that are missing. Then rate and rank those that will drive the most value over the short and long term. Finally, fill in the tools and technology platforms that will allow you to execute on your strategies – not all are created equal! Work with your team through these exercises to ensure you have support along the way. Then when it comes time to make decisions, everyone will be ready to move forward together and understand the reasons behind the new approach.

Having a well-documented outreach plan ensures consistency and efficiency in how to market to realtors as a loan officer. Create a plan tailored to your unique situation, incorporating the strategies you’ve identified as priorities. Again, it’s important to have your team involved and supporting your strategic outreach plan so that when it’s time to deploy it, everyone is onboard and understands their role. This is especially important when it comes to accessing a data platform, as you want everyone to appreciate the value of the tools and also utilize it. WIth everyone on the same page and working the same plan in the same methodical way, you’ll be able to effectively measure and assess the results and value of each strategy employed.

In the competitive landscape of mortgage lending, establishing and nurturing relationships with real estate agents and borrowers is crucial for success. By implementing the right outreach strategies, you can unlock opportunities to grow your business and build lasting partnerships. Remember to continuously evaluate and adapt your approach to stay ahead in this ever-evolving industry. Now, armed with these top agent partner outreach strategies, you’re well-equipped to better cultivate agent relationships and thrive.

As you embark on your agent partner outreach journey, consider watching the MMI webinar on loan officers and agent wallet share as many have found it to be a helpful resource.

We also welcome you to explore our whitepaper on developing the right referral partners. It offers a comprehensive look at these outreach strategies and how MMI uniquely solves for each.