Part 3 of 3 in the Refinance Retention Series

In this final post of the series, we break down the borrower retention strategies, tools, and real-world examples that are helping lenders turn retention into a major growth engine.

Most lenders know they need to improve retention — but many don’t realize just how to increase retention refinance rates – and just much money they’re leaving on the table.

Across the industry, the average borrower retention rate sits at around 20%. That means eight out of ten borrowers are refinancing with someone else when the time comes. But lenders who intentionally focus on borrower retention strategies are seeing something remarkable: they’re doubling that number, reaching 40% to 50% retention, and unlocking millions in additional revenue without spending more on lead generation.

In today’s competitive market, where margins are thin and customer acquisition costs are high, improving borrower retention is no longer optional — it’s essential.

Having direct access and insight into when past borrowers are prime for refinancing is like a view into into a completely new world of revenue potential.

The starting point for any strong retention program is data. More specifically, predictive insights that help lenders identify which borrowers are most likely to refinance — and when.

Leading lenders monitor signals like credit inquiries, home equity gains, loan anniversaries, and engagement patterns. Instead of waiting for the borrower to reach out (or worse, for a competitor to swoop in), these lenders proactively reach out at exactly the right time.

Without this data, you’re flying blind — and often missing the window of opportunity entirely.

Lenders are learning to implement retention strategies and tools to automate compelling marketing campaigns that deliver 1:1 messages at scale.

Of course, data only works when paired with action. And here’s where many lenders fall short: outreach.

Mass emails and generic messages don’t cut it anymore. Today’s borrowers expect communication that’s timely, relevant, and personal. Lenders who learn how to increase refinance retention rates often embrace borrower retention strategies that utilize tools designed to build automated campaigns that deliver personalized messages at scale — tailored to each borrower’s needs and stage in the journey.

For example, a borrower who has gained equity may get a targeted message about cash-out refi options, while another approaching a rate reset might receive a customized refinance offer. This kind of intelligent, segmented outreach consistently outperforms one-size-fits-all campaigns.

One of the biggest challenges lenders face is technology fragmentation. CRM systems, loan origination platforms, and marketing tools often don’t talk to each other — creating silos that make retention efforts clunky or ineffective.

Lenders making real progress on retention are investing in mortgage retention tools that bring everything together. These unified systems combine borrower data, predictive analytics, outreach automation, and reporting in one platform. That makes it easier for sales, marketing, and operations teams to align and execute.

The result? Faster execution, fewer missed opportunities, and a smoother borrower experience.

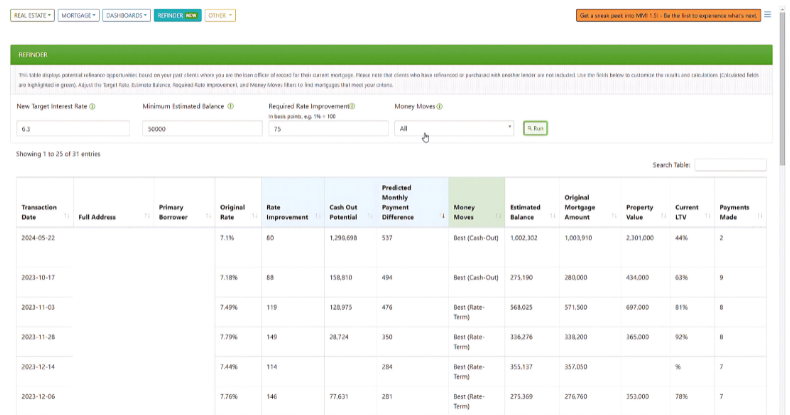

Refinder shows you the best opportunities for refinancing to help you retain your original borrowers. Data like “Rate Improvement”, “Cash Out Potential”, and “Predictive Monthly Payment Difference” are at your fingertips to help you lead the conversation and help your clients.

Retention isn’t just about refinancing. Lenders that want to maximize lifetime value are also using cross-sell and upsell strategies to deepen relationships.

For example, a borrower with growing home equity might be offered a home equity loan or HELOC. Others may be candidates for investment property loans, second-home mortgages, or cash-out options. When lenders combine retention with smart upselling, they create stickier, more profitable relationships. In addition, look for a solution that gives you full visibility into refinance retention by lender by channel.

The key here is relevance. By matching offers to borrower needs, lenders avoid coming across as pushy — and instead position themselves as trusted advisors.

Real-world examples show just how powerful these strategies can be.

A national lender that paired predictive monitoring with automated outreach boosted its borrower retention rate from 18% to 42% in just one year. A regional bank that integrated borrower intelligence with CRM tools doubled its refinance application volume. And a credit union that ran targeted home equity campaigns saw a 30% increase in application flow.

The common thread in these successes? Data, automation, integration — and relentless execution.

Ready to turn retention into real growth? Tools like MMI’s Refinder give lenders the power to identify refinance-ready borrowers, automate outreach, and dramatically increase retention — often by as much as 50%. MMI aoso gives you full visibility into refinance retention by lender by channel.

Discover what your team could be capturing:

Watch your Own Refinder Video here.

Explore your Company-Wide Refinder Video here.

If you’re ready to improve retention, here’s a simple playbook:

Assess where you stand

Look at your current retention rate. Where are you losing borrowers?

Adopt predictive monitoring

Implement tools that surface refinance opportunities in real time.

Personalize outreach

Automate campaigns that deliver relevant, timely messages.

Integrate your tech stack

Break down silos between CRM, LOS, and marketing platforms.

Align your team

Make retention a shared goal across sales, marketing, and operations.

For lenders, improving the borrower retention rate is no longer a side project — it’s a core growth strategy. By combining predictive insights, personalized outreach, and unified technology, lenders can not only stop churn but also unlock major new revenue streams.

The bottom line? Retention is the new growth engine. Make sure your organization is ready to turn it on. For a demo of MMI’s Refinder, request one here.