The mortgage industry is in constant motion. Rates move, buyers shift their preferences, and technology continues to reshape the way professionals work. In 2025, these changes are happening faster and with more impact than in the past. For lenders, recruiters, and executives, success depends on understanding mortgage industry trends early and taking action before competitors do. The companies that adapt quickly will capture more business, while those that hesitate risk losing ground.

The mortgage industry is in constant motion. Rates move, buyers shift their preferences, and technology continues to reshape the way professionals work. In 2025, these changes are happening faster and with more impact than in the past. For lenders, recruiters, and executives, success depends on understanding mortgage industry trends early and taking action before competitors do. The companies that adapt quickly will capture more business, while those that hesitate risk losing ground.

This article explains the most important mortgage industry trends in 2025 and shows how MMI equips professionals to adapt. From automation and data analytics to daily homeowner engagement and smarter marketing, you will see how MMI’s connected platform gives teams the tools to lead in a changing market.

Several forces are shaping today’s mortgage market. Teams are relying more heavily on data and automation to guide decisions. Recruiting and retention strategies are shifting to emphasize precision and personalization. Consumer behavior continues to evolve as younger generations enter the market and remote work drives new buying patterns.

For professionals, these shifts create pressure but also opportunity. When you know who is producing, where markets are growing, and which relationships need attention, you can act faster and more effectively. MMI provides that visibility by consolidating nationwide production and relationship data into one platform. With MMI, you can see the full picture and move quickly when opportunity appears.

The most important mortgage industry technology trends revolve around automation, easy access to data, and real-time visibility. Manual reporting and static spreadsheets can no longer keep pace with the speed of today’s market.

Automation and AI are reshaping how professionals work. Instead of waiting for a report, leaders need instant answers. ChatMMI delivers this by letting you type in plain language questions like “Who are the top purchase loan officers in Texas this quarter?” and receive immediate results. This type of speed gives teams the ability to make decisions in the moment, not weeks later.

Data has become the foundation of growth. Without clear and reliable information, leaders risk guessing and missing opportunities. The MMI Data Center provides a single source of truth for nationwide loan officer and agent production. It allows teams to filter by state, loan type, or referral relationship and see trends at the exact level of detail needed.

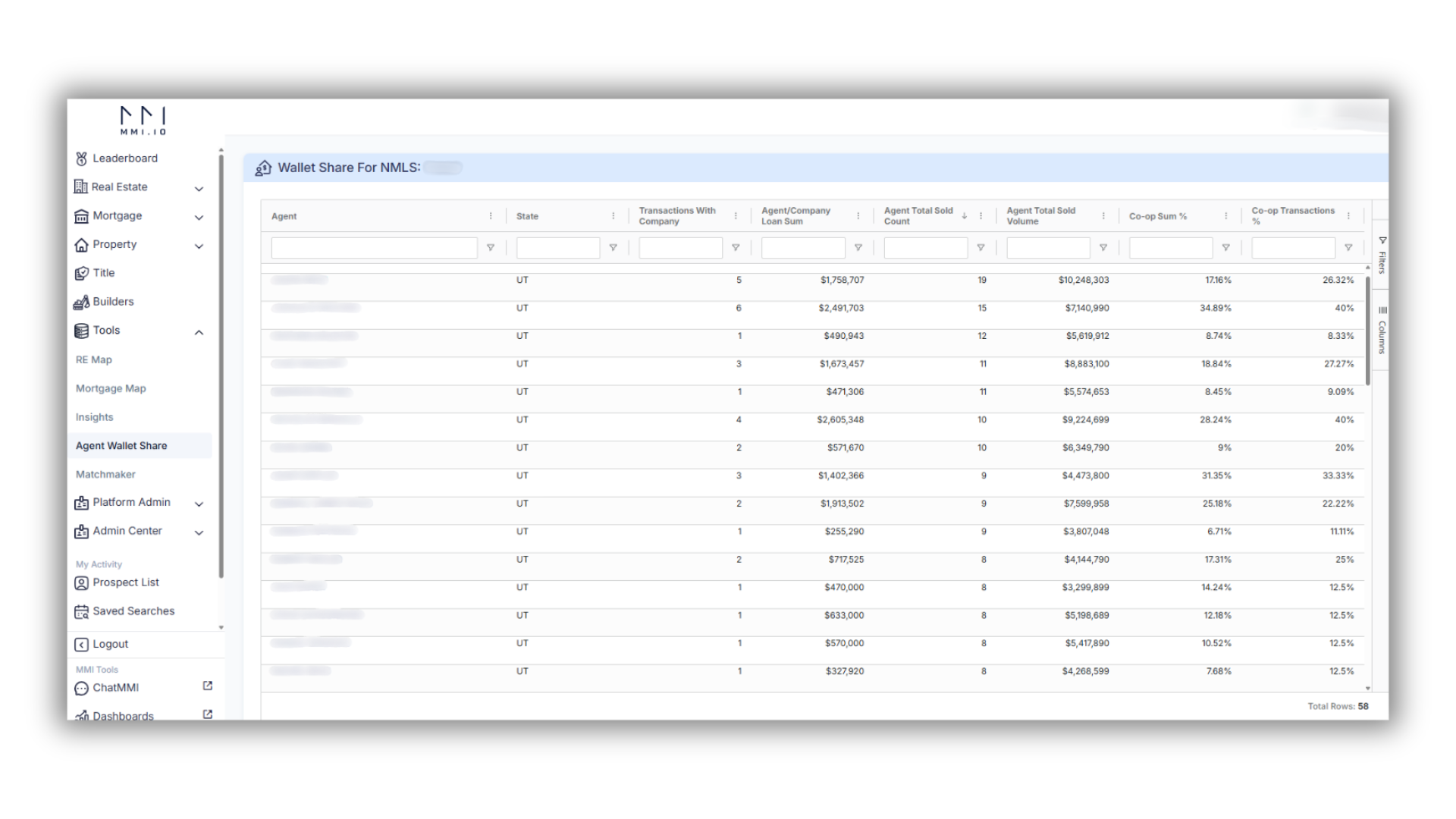

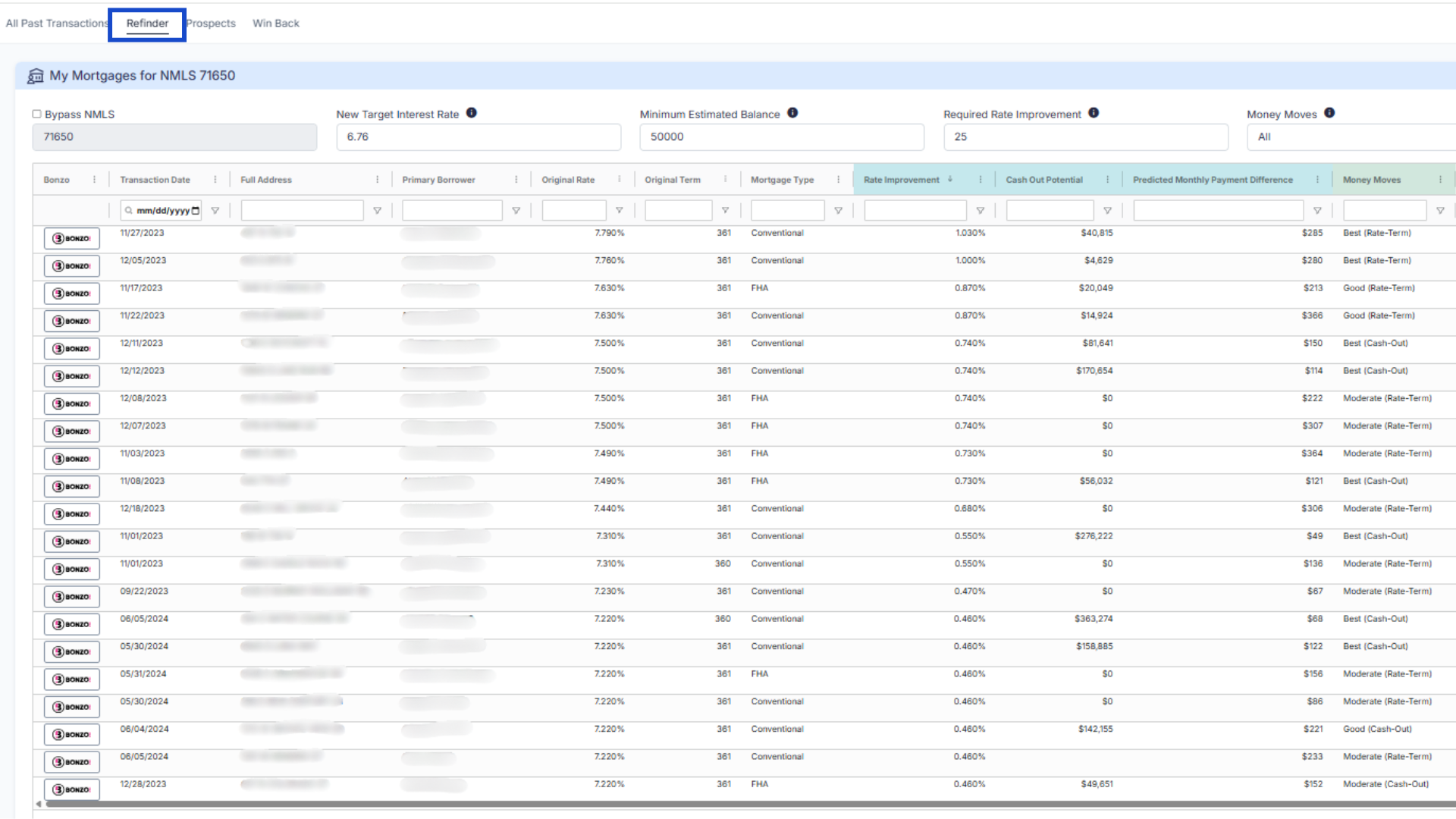

Another major technology trend is the ability to spot changes before they cause damage. If a referral partner begins to shift deals elsewhere or if a loan officer’s volume starts to slip, catching the change months later is too late. Wallet Share and Refinder Alerts in MMI give early signals so professionals can respond quickly, protect relationships, and win business back. These tools show that real-time visibility is no longer optional—it is required.

The best mortgage marketing strategies are built on relevance and proof. Instead of blasting the same message to everyone, lenders and recruiters now focus on outreach that feels personal, timely, and backed by data.

Personalization is central to marketing success in 2025. A generic recruiting message is easy to ignore, but a note that references a loan officer’s recent closings or top referral partners is far more powerful. With MMI, recruiters can see that production history and use it to shape outreach that earns attention and builds trust from the very first conversation.

Digital engagement has also become essential. MMI makes it easy to create lists of the exact producers who matter most. And then layer on ChatMMI, which is a total game changer to access data insights: You ask it a question: It answers you immediately. MonitorBase then closes the loop with borrower insights and alerts, including predictive analytics that can give you a 90-day lead on your competitors on potential/likely borrower needs. You can then push this directly into Bonzo or your current CRM–from Total Expert to Salesforce–via webhook to deliver the right message to the right person at the right time–including all contingencies across your business: from LOs, to agent partners, and your borrowers. And Bonzo allows you to personalize communications at scale via SMS, voice mail drop, email, etc.

Finally, with MMI’s Refinder, we’ve seen clients realize a 30%-50% increase in refi retention–this is such a layup leading to easy revenue that is currently being lost at industry average of 80%! We’ve built a customized video that explains your current retention rate as a unique LO, and the potential increases in refi revenue here: https://web.mmi.io/refindervid/

And another customized video that asks for your Company NMLS to see your overall organization’s retention rate and opportunities for improvements here: https://web.mmi.io/corefindervid/

This is REAL, TANGIBLE REVENUE that lenders are losing every day. There’s no reason we can’t flip the industry average retention rate on its head from 20% to 80%-90%: We have all the data sitting there for everyone! Let’s do this.

MonitorBase then closes the loop with borrower insights and alerts, including predictive analytics that can give you a 90-day lead on your competitors on potential/likely borrower needs.

Personalized campaigns with actionable data Trust grows when professionals share useful insights rather than hard sales pitches. With MMI dashboards and reports, teams can turn complex production data into simple visuals that are easy to share. These can be used in recruiting presentations, market updates, or social posts. Over time, this steady flow of clear, data-backed insights positions your team as the go-to expert in the market.

One of the most important trends in 2025 is the focus on retention and long-term engagement. Many lenders still rely on occasional emails or calls to past clients, but that is not enough to keep borrowers loyal in a competitive market. Pathways Home changes the game by acting as a daily engagement hub.

Pathways Home is a white-labeled mobile app that carries your brand. It delivers equity updates, home value trends, refinance opportunities, and personal financial insights directly to homeowners. Borrowers see your logo and colors every time they check the app, not ours. Because it requires zero daily effort from your team, it continues to add value long after closing without adding to your workload. By staying in front of past clients every day, Pathways Home builds loyalty and makes sure you are the first call when a new need arises.

A bit more on the power of Bonzo: Even the best content fails if no one sees it. Many teams want to publish educational updates and market insights but struggle to find the time. Bonzo solves this by automatically sending videos, newsletters, and timely notes to your audience. Loan officers do not have to log in daily for this to happen. Once campaigns are set, Bonzo makes sure your audience hears from you consistently.

This consistent communication builds trust. Borrowers, referral partners, and prospects come to see your team as the one providing helpful information, not just sales messages. Over time, that steady voice leads to stronger relationships and more inbound conversations.

A simple way to combine technology trends in mortgage industry work with modern marketing is to create a loop between MMI Data Center and Bonzo.

Teams use MMI Data Center to pull simple market insights, such as a month-over-month change in purchase volume, a shift in loan mix, or the ranking of top agents in a specific county. They turn this information into a clear chart or one-page visual and then distribute it with Bonzo through email, SMS, voice mail drops, etc. This process gives producers and partners timely market intelligence and keeps your brand in front of the right audience on a consistent basis.

This process positions your team as the expert in your market. Because the content is based on fresh, reliable data, it builds trust quickly. And because Bonzo handles distribution, your team can stay focused on production while still maintaining a strong, visible presence. Content created from MMI Data Center and MonitorBase, distributed through Bonzo, is content that drives inbound conversations.

Although MMI serves mortgage professionals, consumer behavior continues to influence where and how business gets done. Two changes are especially important today.

The first is generational. Millennials and Gen Z now represent a growing share of homebuyers. These groups expect digital updates, quick communication, and transparency. Loan officers who meet those expectations gain more business. With MMI, you can see which professionals are already succeeding with these buyers and target recruiting toward them.

The second is geographic. Remote and hybrid work continue to change where people buy homes. Smaller cities and suburban areas are gaining ground as people move for space and lifestyle. MMI makes it easy to see these shifts with geographic production maps. This allows lenders and recruiters to adjust strategies and focus on the markets where growth is happening now, not where it happened years ago.

Each MMI product is powerful on its own. But when combined, they create a compounding effect that multiplies results. Data Center gives you the market view. MonitorBase provides borrower intent signals. Bonzo delivers educational outreach automatically. Pathways Home keeps past clients engaged every day. Together, these tools create a complete loop of insight, engagement, and action.

Using two or three products at once produces measurable gains in leads, retention, and return on investment. Instead of scattered tools and disconnected systems, MMI brings everything together in a unified platform designed for growth.

The biggest mortgage industry trends 2025 point to a future shaped by technology, data, marketing precision, and changing buyer behavior. To win in this environment, professionals need tools that reveal opportunities, simplify decisions, and keep borrowers engaged long after closing.

MMI delivers all of this in one connected solution. ChatMMI provides instant answers in plain language. The MMI Data Center shows production and relationship trends across the country. Wallet Share and Refinder Alerts give early warnings when business shifts. MonitorBase identifies borrower intent signals. Bonzo automates education and distribution. Pathways Home powers daily homeowner engagement under your brand. Together, these tools give you the clarity, speed, and confidence to adapt to change and stay ahead.

👉 Book a of ChatMMI demo today, or request a live, in-person demo of Pathways Home at 2025 MBA Annual to be one of the very first exclusive handful of industry professionals to experience the future of daily homeowner engagement.

It’s all here just waiting for you–in a single solution. Let’s talk.