MMI is well aware of specific lending requirements that banks and credit unions must adhere to. That’s why in addition to the same features available to traditional lenders, we have developed — and continue to develop — tools in MMI to serve the needs of BCUs.

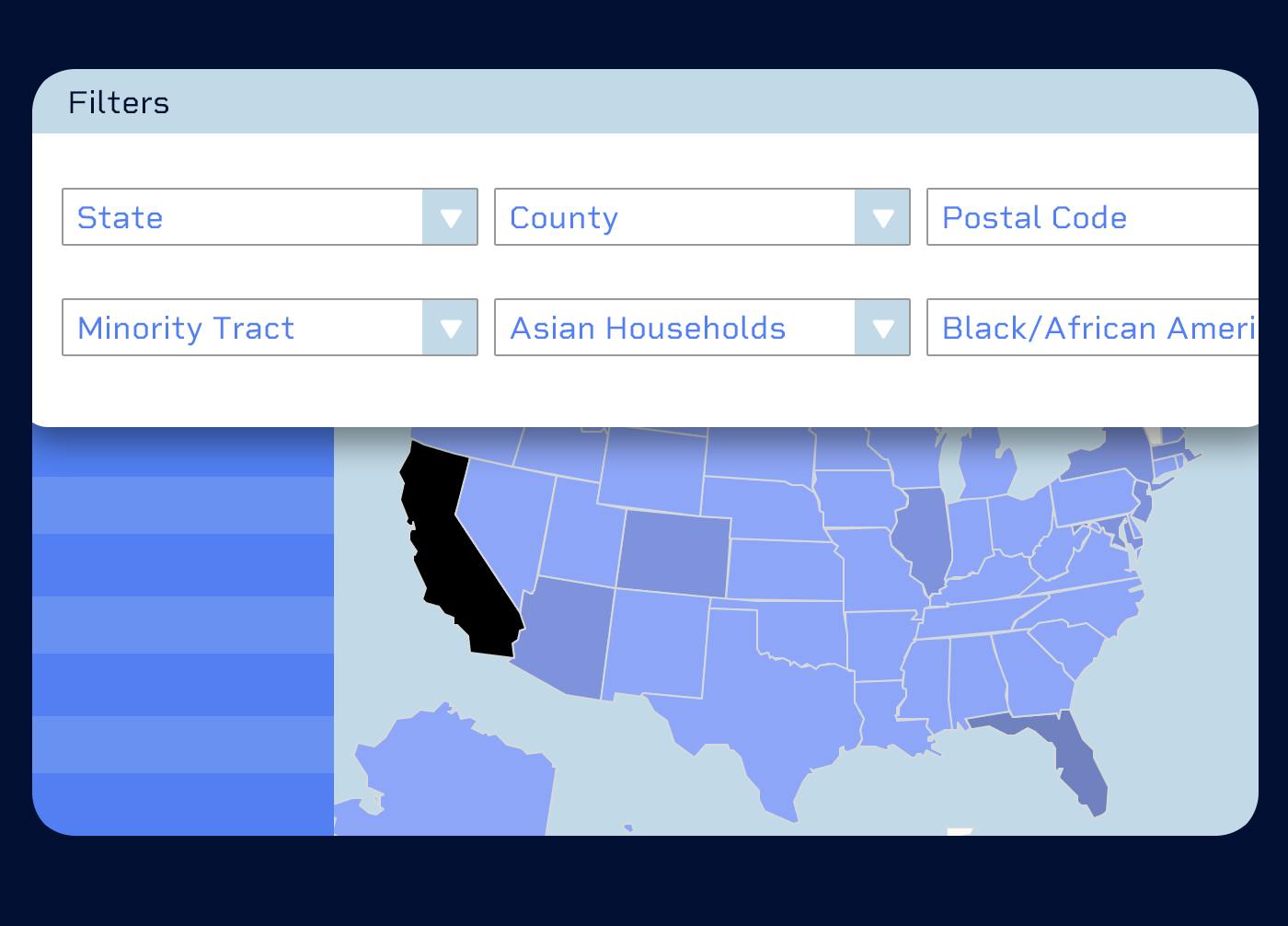

MMI’s CRA and LMI Visual Intelligence boards provide a quick and easy-to-digest view into institutional performance by region.

It’s never been more important for BCUs to be proactively identifying and recruiting LOs who are lending in underserved communities. MMI turns this process into something a recruiter can do in minutes.

Use MMI to monitor all bank customer and credit union member addresses to identify any opportunities or risks of fallout.

Request a demo to see exactly why banks and credit unions choose MMI for their mortgage data needs.