The mortgage industry is full of powerful technology, yet many lenders still struggle to connect it all. Teams bounce between CRMs, alert systems, spreadsheets, and marketing tools, wasting hours on tasks that could easily be automated. These disconnected systems slow down productivity and create inconsistent borrower experiences. The future of mortgage technology depends on integrations and automation in mortgage—a shift that connects data, communication, and engagement into one seamless workflow.

When data flows freely between systems, lenders gain more than convenience. They gain visibility, speed, and the ability to act on opportunities the moment they arise. That’s why connected platforms like MMI, Bonzo, and MonitorBase have become essential to modern lending operations. Together, they form a digital mortgage ecosystem that turns data into action, automates repetitive work, and builds stronger borrower relationships.

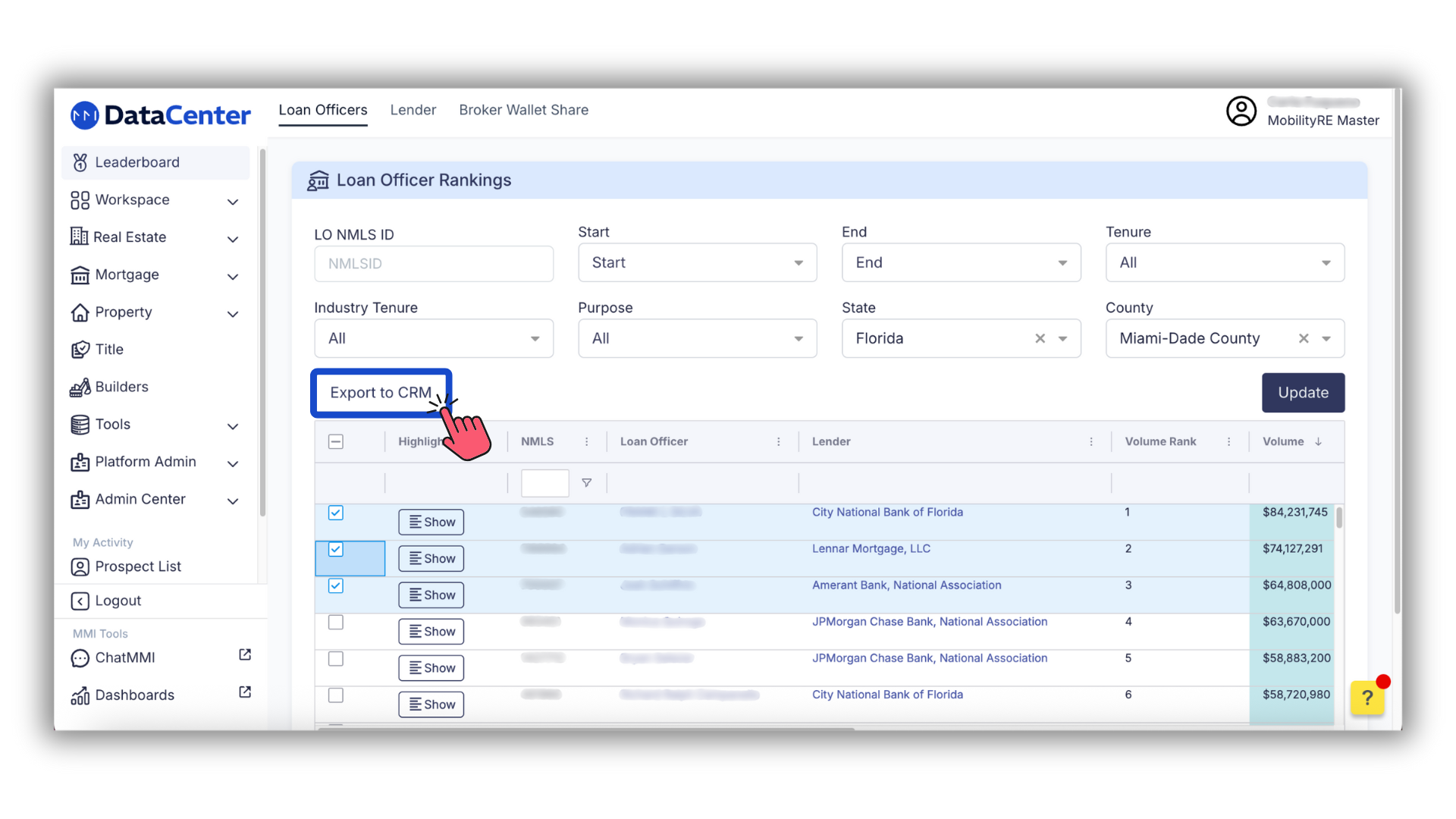

Manual work remains one of the biggest drains on productivity for mortgage teams. Even simple daily tasks—like exporting lists, sending follow-ups, or checking for loan anniversaries—can consume valuable time that could be spent engaging with clients or partners. These delays make it harder to compete in a market where responsiveness and personalization drive success.

Mortgage automation eliminates these challenges by handling repetitive tasks instantly and accurately. Instead of pulling data manually, integrated systems update themselves. Instead of relying on memory for follow-ups, automated workflows ensure borrowers receive the right message at the right time. Lenders gain speed, marketers gain scale, and recruiters gain efficiency—all without additional resources.

Automation doesn’t just streamline workflows; it enhances accuracy and compliance. With verified data driving every campaign, lenders reduce errors, stay audit-ready, and deliver consistent communication across departments. The result is a more agile operation that moves faster and smarter than ever before.

Automation becomes transformative when systems connect. The most advanced lenders rely on mortgage technology integrations that unify marketing, recruiting, and borrower engagement under a single data source.

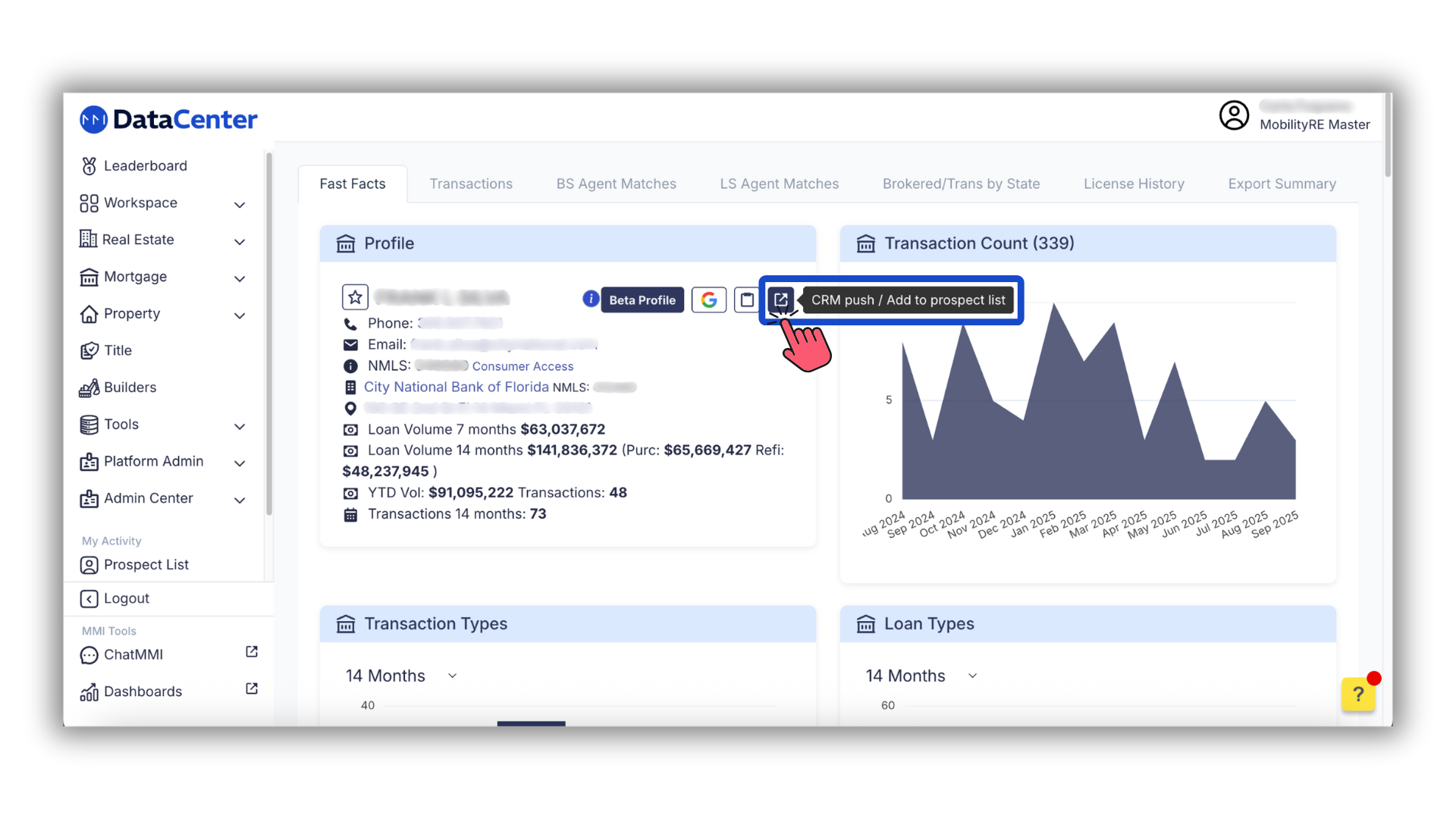

When MMI integrates with Bonzo and MonitorBase, it redefines how lenders move from insight to action. Bonzo’s automation engine manages outreach at scale, while MMI provides verified production and contact data to keep every campaign precise. For example, when a referral partner hits a new milestone, that information in MMI automatically fuels a personalized Bonzo campaign to celebrate the achievement or offer new opportunities.

The connection between MMI and MonitorBase adds another layer of intelligence. MonitorBase identifies borrowers showing early signs of activity—like checking credit or listing their home—and immediately sends alerts that sync back to MMI or a lender’s CRM. From there, Bonzo can automatically deliver a tailored message sequence. This is mortgage CRM automation at its best: data, timing, and communication working together to reach borrowers first.

By linking these tools, lenders eliminate silos that once separated departments. Marketing, recruiting, and retention teams all operate from the same, real-time data foundation, giving them confidence that every outreach is accurate and timely.

Automation is only as powerful as the data behind it. Outdated or inconsistent records can derail even the best workflows. That’s why MMI’s verified data serves as the backbone of automation for many of the industry’s leading lenders.

MMI aggregates nationwide production data and referral relationships, verifies every record for accuracy, and feeds it into integrated systems like Bonzo and MonitorBase. This ensures every automated campaign, alert, or report runs on clean, current information. When all teams—marketing, recruiting, and operations—share the same verified data, collaboration becomes faster, and decisions become more strategic.

Accurate data also ensures compliance and consistency. Whether it’s powering a marketing campaign or generating a predictive borrower alert, MMI keeps every integration reliable and aligned with industry standards.

Top-performing lenders use mortgage marketing automation to build consistent communication without relying on manual processes. The combination of MMI’s verified intelligence, Bonzo’s communication engine, and MonitorBase’s predictive alerts creates a complete, automated marketing loop.

With these integrations, lenders can segment contacts by market, production level, or referral relationship and automatically deliver campaigns relevant to each audience. When a borrower shows new intent through MonitorBase, Bonzo immediately sends a prebuilt sequence that educates or re-engages them. Meanwhile, MMI continuously refreshes the underlying data so outreach stays accurate and compliant.

This connection between verified intelligence, predictive alerts, and automated communication ensures that lenders never miss an opportunity. Borrowers receive timely, personalized messages that feel authentic, and lenders maintain continuous engagement without needing to manually manage each step.

The mortgage industry is rapidly shifting toward open, integrated systems that work together through shared data environments. These digital mortgage ecosystems allow lenders to combine best-in-class tools—like MMI, Bonzo, and MonitorBase—without adding complexity.

By connecting platforms through APIs, lenders reduce tool fatigue, minimize data duplication, and improve visibility across departments. A change made in MMI automatically reflects across other systems, ensuring every team—from compliance to marketing—has the same, real-time view of borrower and market activity.

For lenders, this integration simplifies operations, accelerates response times, and makes their tech stack work as a single, intelligent unit. The outcome is faster decision-making, improved productivity, and a smoother borrower experience from start to finish.

The real power of integrations and automation in mortgage appears when MMI, MonitorBase, and Bonzo are used together. Each platform contributes a unique layer of capability, but combined, they create a fully connected system that turns data into action and relationships into results.

MMI delivers the intelligence—accurate production data, referral relationships, and market insights that form the foundation for smarter decisions. MonitorBase adds the predictive element, alerting lenders when borrowers show signs of intent or refinance potential. Bonzo completes the cycle by automatically executing communication workflows that respond instantly to those signals.

When these platforms work in sync, data from MMI powers alerts from MonitorBase, and Bonzo responds with compliant, personalized messaging—without requiring manual input. This integration ensures no opportunity slips through the cracks. Loan officers can engage borrowers at the perfect time, with the right information, and without breaking their daily rhythm.

Lenders that leverage this connected system report faster borrower response times, stronger referral engagement, and improved retention rates. By using MMI, MonitorBase, and Bonzo together, teams gain a single ecosystem that’s proactive, efficient, and deeply human. It’s the future of mortgage automation—a perfect balance of data, prediction, and communication that drives measurable growth.

Some worry that automation could replace personal touch, but in reality, it strengthens it. When systems handle repetitive work, loan officers gain time to focus on building real relationships. In a well-connected digital mortgage ecosystem, automation manages the “when” while humans handle the “why.”

One regional lender using MMI, Bonzo, and MonitorBase re-engaged hundreds of past borrowers flagged for refinance activity. Automated workflows identified the opportunities, triggered timely outreach, and allowed the team to focus on conversations rather than data management. Borrowers appreciated the proactive communication, and conversion rates rose significantly—all without adding staff.

Automation didn’t make their process less personal; it made it more consistent, reliable, and responsive.

The path forward for lenders is clear: efficiency depends on connection. Integrations and automation in mortgage technology are transforming how lenders operate by bridging data, communication, and engagement.

By combining MMI’s verified intelligence, MonitorBase’s predictive alerts, and Bonzo’s automation tools, lenders can streamline workflows, improve accuracy, and strengthen borrower relationships. This unified approach empowers teams to act faster, stay connected, and grow smarter in a competitive marketplace.

Ready to see how these platforms work together?

Schedule a live demo to explore how MMI and its partners can help automate your workflow, engage borrowers earlier, and retain clients for life.