Learn how MMI and MonitorBase help loan officers win more deals with agent referrals mortgage strategies powered by relationship data, borrower alerts, and predictive insights.

Most loan officers know referrals drive business — but not all referrals are equal. The best source isn’t paid ads or cold leads. It’s the trust built between real estate agents and their clients. A real estate agent mortgage referral doesn’t just bring in a lead; it brings in a borrower who’s already ready to act.

Top loan officers win because they use data to spot, grow, and protect referral pipelines. With Mobility Market Intelligence (MMI) and MonitorBase, you don’t just wait for referrals to happen — you find them, track them, and build on them.

Borrowers rely on the people they trust. More than half of them pick their lender because of a referral, usually from their real estate agent.

That makes referrals one of the strongest lead sources. Agents protect their reputation by sending clients only to lenders who deliver. For loan officers, this makes referrals more reliable and higher converting than online ads or cold lead lists.

The problem is most LOs only see part of the picture. Without the right tools, you don’t know which agents are sending business your way, which are splitting deals with competitors, or where new chances exist. MMI shows you the full referral network so nothing gets missed.

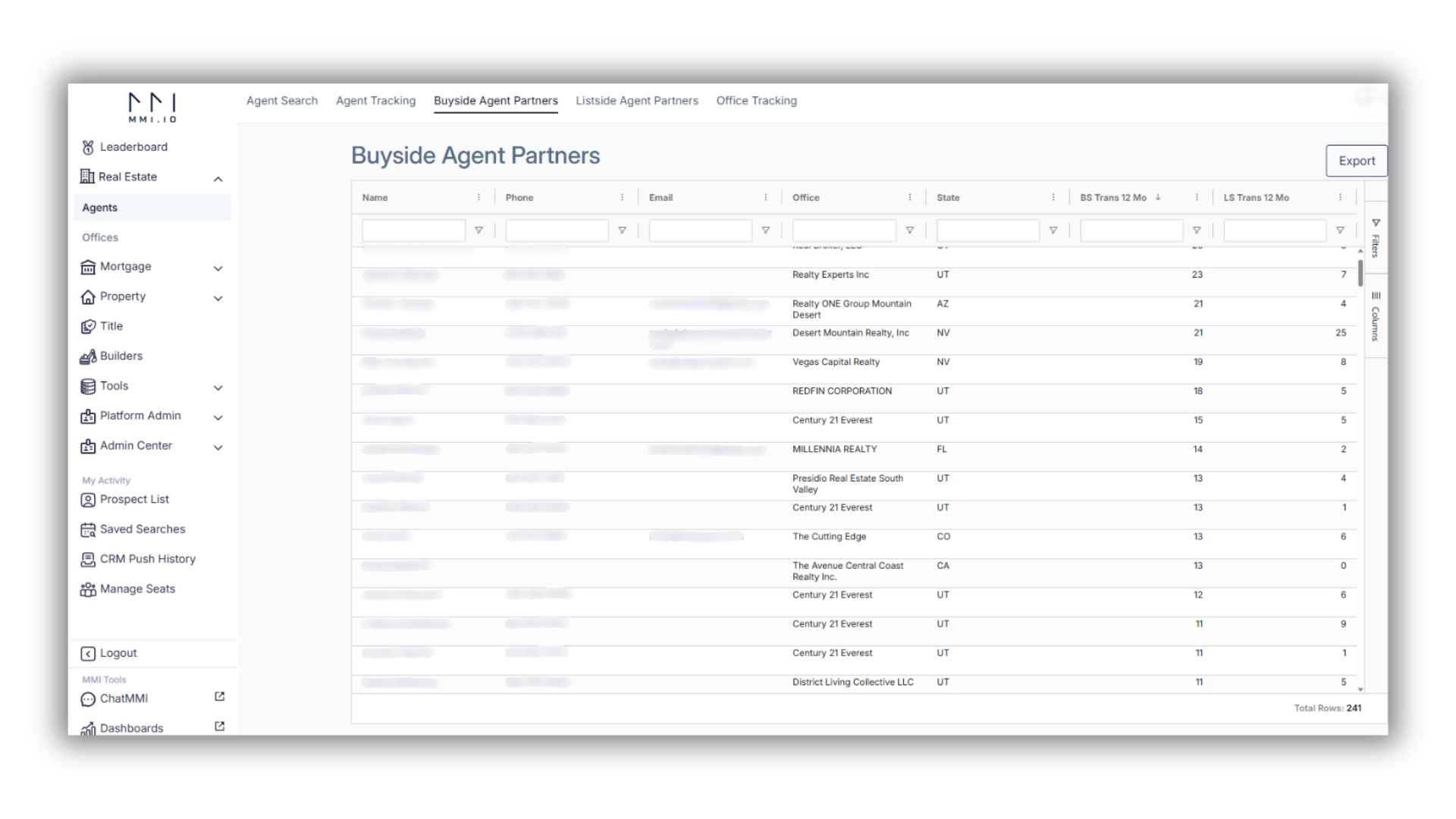

Most loan officers know a few of their top referral partners. Beyond that, things get blurry. Are there strong agents you haven’t connected with? Are competitors gaining ground with the ones you know?

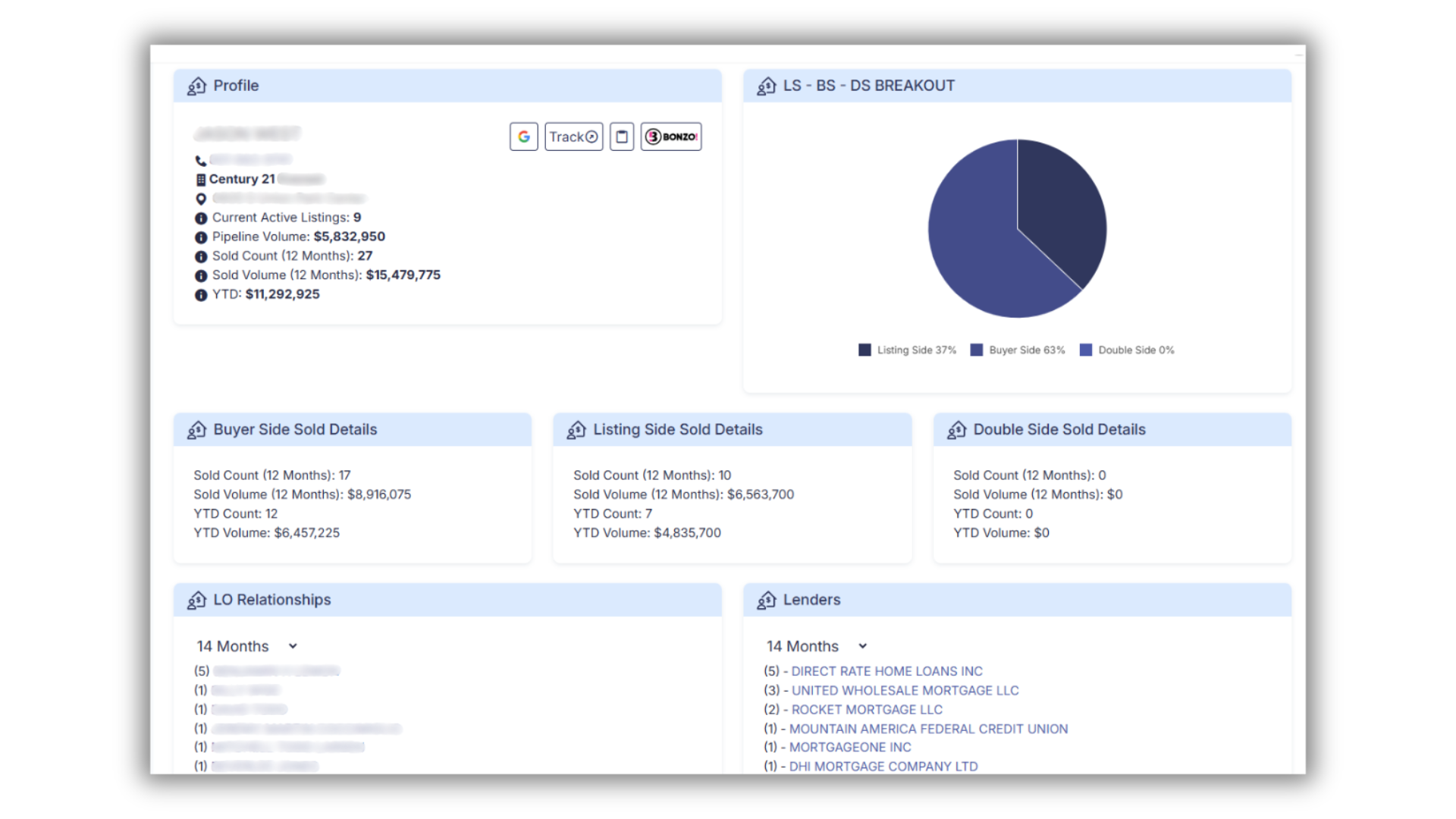

MMI Agent Intelligence gives you that clarity. It reveals agent production history, deal flow, and lender relationships. With this view, you can focus on the agents who can truly grow your business.

This helps you move from waiting around to actively winning referrals.

Agents don’t need another LO saying, “I’ll take care of your clients.” They want partners who add value to their business.

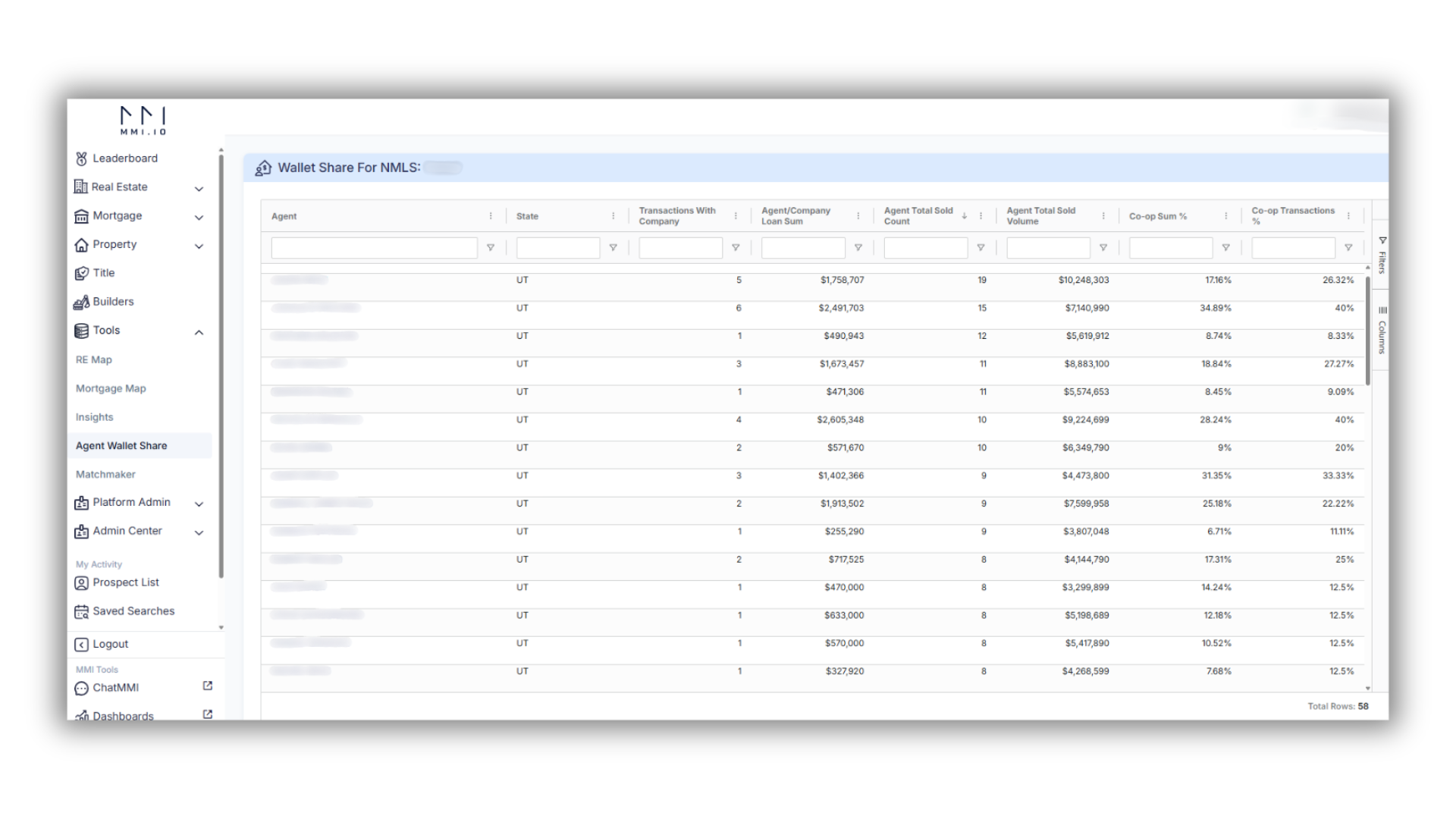

With Wallet Share, you can show an agent how much of their business you’re winning and how much is going to other lenders. If an agent closed 20 deals last year and only two came through you, that’s an easy way to start a real conversation.

This kind of transparency builds credibility. It turns you from another loan officer asking for business into a partner with data they can use. It also supports better agent lead generation by helping you prioritize outreach to the right partners.

A mortgage broker referral program can be useful for creating structure, but it only works if it’s built on the right agents. Without the right targeting, these programs waste time.

MMI makes sure your referral programs are backed by production data, so you invest in agents who actually deliver. And with MonitorBase Predictive Scenario Alerts, you get another edge. When a borrower in your database shows early signs of making a move, you can reach out to the agent tied to that borrower. That creates a natural reason to reconnect and keeps the mortgage referral network strong.

Partnerships don’t build themselves. You need steady follow-up and timely outreach to stay connected.

MMI helps by pushing agent data into your CRM so you can keep your pipeline organized. Pair that with automation tools like Bonzo, and you can create workflows that remind you to follow up when an agent closes a deal with someone else.

And with ChatMMI, you can prepare for a meeting in seconds. Ask for an agent’s transaction history or their top partners, and you’ll walk in ready. That preparation makes you look professional and makes every conversation count.

Technology also ties into mortgage affiliate programs, where consistent branding and automated outreach can expand your reach without more manual effort.

Referrals can’t be left on autopilot. Markets change, relationships shift, and borrowers shop around. You need to measure what’s working and adjust fast.

Refinder shows when past borrowers worked with another lender. Agent Intelligence and Wallet Share track how referrals flow and whether you’re gaining or losing share.

Even better, MonitorBase borrower alerts use predictive data to show when someone might be preparing for a new loan. This gives you a head start over competitors — especially now that traditional credit trigger leads may be banned. Instead of reacting, you’re reaching borrowers and their agents before anyone else.

AI and predictive tools aren’t just on the horizon — they’re already here. ChatMMI is changing how LOs prepare for agent conversations today.

Now, predictive referrals are possible. That means knowing not only which agents are likely to send you business but also when a borrower might be ready to move. With MonitorBase alerts, you can contact the agent connected to that borrower at the right moment, creating alignment that competitors can’t match.

The combination of MMI’s agent insights and MonitorBase alerts gives you a major advantage: you’re creating referrals instead of waiting for them.

Referrals are still the strongest way for loan officers to grow. A real estate agent mortgage referral is more than just an introduction — it’s a business opportunity built on trust. But in today’s market, trust isn’t enough. You need data and predictive insight to protect and expand those relationships.

With MMI Agent Intelligence, Wallet Share, Refinder, ChatMMI, the Data Center, and MonitorBase borrower alerts, you can build stronger referral networks, protect current deals, and find new ones.

And here’s the extra value: you can share borrower insights with agents, showing them when their clients might be ready to act. That strengthens your role as their go-to partner.

If you’re ready to stop leaving referrals to chance and start winning them with confidence, MMI and MonitorBase are here to help.