In the quest to recruit top mortgage loan officers, understanding specific performance metrics is paramount to calculating the potential value a loan officer can bring to your company. Once you learn how to check loan officer production numbers and assimilate them into your strategy, you can then decide which are most important for your company’s current initiatives and goals.

There are several database tools that provide varying levels of loan officer production key performance indicators (KPIs). In this blog post, we’ll delve into the key performance metrics to focus on when evaluating top mortgage loan officers and how to check loan officer production. And we’ll then recommend steps to jumpstart your initiative.

Utilize a mortgage data platform to check loan officer performance metrics.

Recruitment isn’t a shot in the dark—it’s a calculated process. By considering specific KPIs, you can identify loan officers who possess the potential to contribute meaningfully to your organization. When you are consider how to check loan officer production, these are the performance metrics you should prioritize:

1. Loan volume

2. Transaction data & analysis

3. Geographic concentration of loans

4. Established agent relationships

5. License history

To add some further context from accomplished industry professional, Ben Green, Recruiting and Strategic Partnerships Leader at Elite Performance Associates, said in a MMI webinar:

“There isn’t one single loan officer data section or field that is more important than another. They all ‘flow’ from one into the next based on the narrative or search you’re looking to identify. This can be based on market share, niche product specialties, platform match, or plenty of other variables. Some lenders may be a better home for top producers with a lean toward jumbo loans, while others may be aggressively focused on non-coastal geographies doing a bunch of new construction. You must know your own story to know what data to focus on and where it is leading you next.”

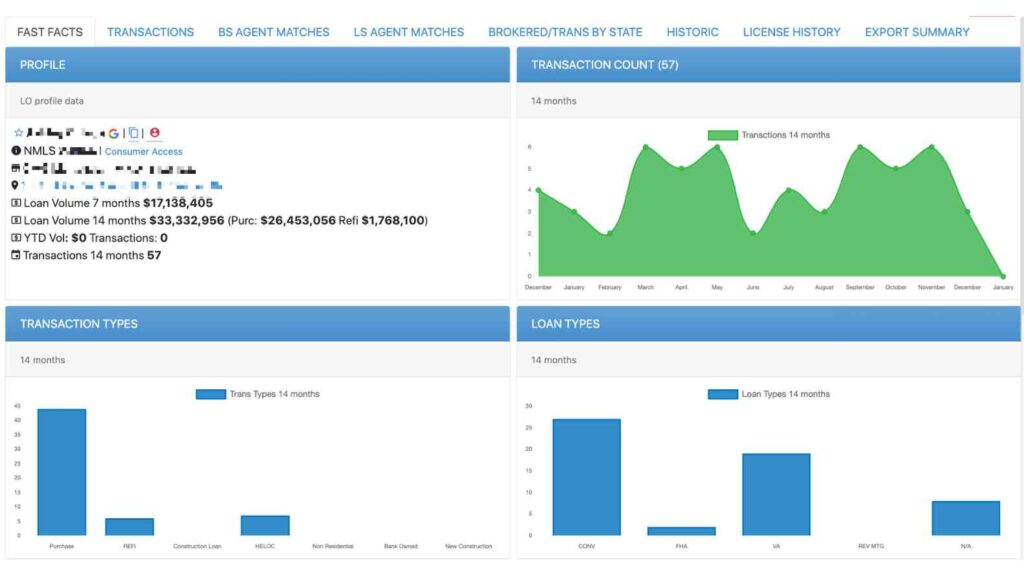

Loan volume serves as a tangible indicator of a loan officer’s productivity. Metrics like 7-month, 14-month, and year-to-date (YTD) loan volumes provide insights into the officer’s consistent performance over time. A high volume can indicate a loan officer who can handle a significant workload effectively. But there are also instances where a loan officer processes a lower volume, but is equally effective at handling the demands of the role.

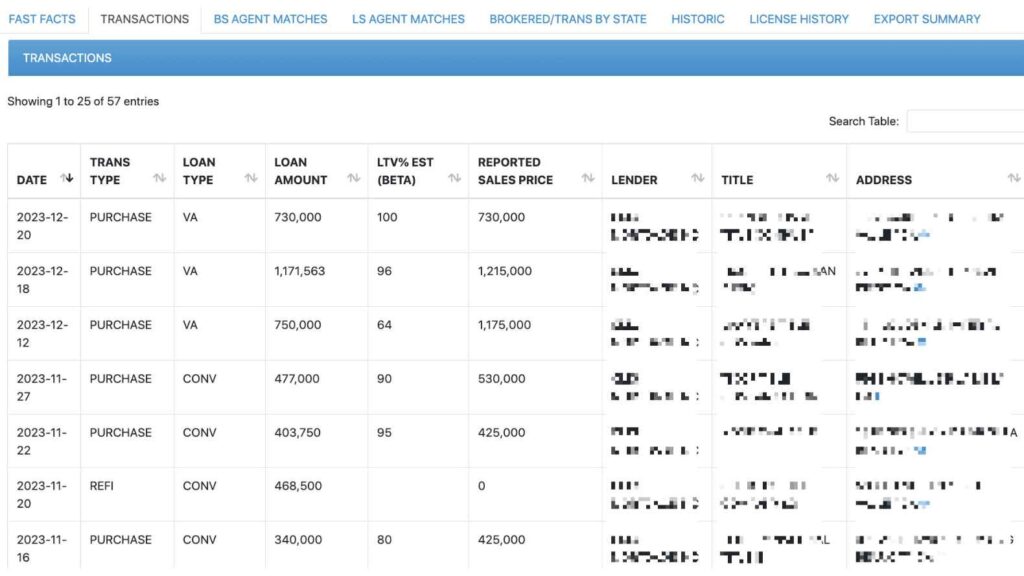

Tools like MMI provide comprehensive transaction data from the past 14 months. Among other metrics, this data encompasses critical details about the transaction type (e.g., purchase, refinance, construction loans, HELOC, Non-Residential, Bank Owned, and New Construction). And it will also provide you information on Loan Type (CONV, FHA, VA, REV MTG, etc.). We’ll now provide some of the transaction and loan types that this type of system provides. With them, as you look how to check loan officer production, we’ll include the skills a loan officer needs to be high performing in to successfully process and complete them.

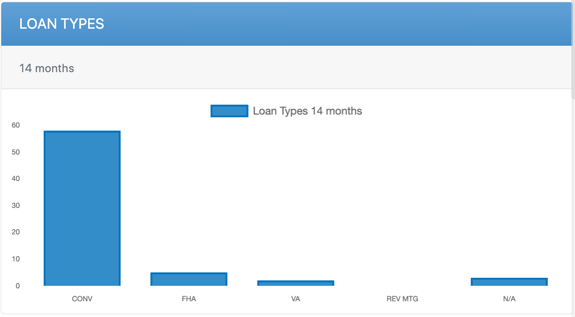

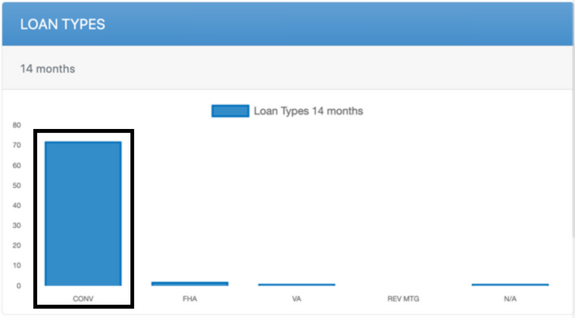

Your data platform should be able to show you a breakdown of the percentage of loan types that a loan officer has transacted.

A home purchase loan is a financial instrument designed to make homeownership aspirations a reality. A loan officer’s role is pivotal in guiding potential homebuyers through this intricate process. This type of loan empowers individuals and families to secure their homes by providing the necessary funds to purchase a property.

When a client approaches a mortgage loan officer for a home purchase loan, the loan officer’s experience and expertise comes into play at the beginning of the process. The loan officer carefully evaluates their financial situation, credit history, and income to determine their eligibility for a mortgage. Through thorough analysis, the loan officer helps them understand the loan options available. And they also assist them in selecting the best-suited one for their circumstances.

A refinance loan is a powerful financial tool that allows homeowners to reevaluate and optimize their mortgage arrangements. A loan officer’s role in processing a refinance loan is critical in helping clients meet their financial goals. This is achieved by leveraging the equity they’ve built in their homes.

If Refi transaction history is important to the role you’re hiring for, first consider how loan officers in your candidate pipeline compare to their peers. Using MMI dashboards, recruiters can filter LO benchmarks to determine the average number of deals and production volume for LOs in the specific county they’re recruiting for. For example, a recruiter scouting in California can see that loan officers in the Gold tier ($10-19M production/year) closed an average of 3.5 deals from 01/2023 – 08/2023.

A construction loan is a specialized financing solution that paves the way for individuals to transform their visions of a custom-built home into reality. Collaboration and transparency are key in processing a construction loan. The loan officer works closely with appraisers, contractors, and inspectors to validate project estimates and ensure they align with the loan amount. Expertise in project assessment and risk management safeguards both clients and lenders. From a transparency standpoint, the loan officer clearly explains the terms of the construction loan. This includes draw schedules, interest rates, and repayment structures.

The culmination of the loan officer’s efforts is the final disbursement upon project completion. The loan officer oversees the coordination between the lender, borrower, and builder. This ensures a smooth transition from construction to permanent financing, if applicable.

A non-residential loan, also known as a commercial loan, is a financial instrument designed to support businesses and investors in their ventures beyond residential properties. When clients seek a non-residential loan, the loan officer steps into the role of a strategic partner. The initial task is to understand the unique nature of their commercial project. Whether they’re acquiring a commercial property, expanding their business, or financing a development project, the loan officer’s insights are crucial. This is because they are responsible for then structuring a loan solution that aligns with their objectives.

Financial analysis becomes the cornerstone of the loan officer’s process. They meticulously assess the client’s financial strength, business plan, and projected revenue streams to evaluate the feasibility of the project. Collaboration is key in processing a non-residential loan. The loan officer works closely with appraisers, inspectors, and legal experts to validate property values, and assess project viability. They also ensure compliance with regulations.

Upon project completion, the loan officer oversees the closing process, ensuring all necessary paperwork is in order. They facilitate a smooth transition from the loan disbursement phase to the ongoing management of the commercial property or venture.

A bank-owned loan, often referred to as a real estate owned (REO) loan, is a unique financing solution for individuals and investors. They are looking to purchase properties that have been repossessed by a bank. The loan officer’s role is pivotal in guiding clients through the intricacies of acquiring a bank-owned property and securing the necessary financing. When clients express interest in a bank-owned property, the loan officer steps into the role of a trusted advisor. The first task is to understand their goals and objectives for the purchase. Whether seeking to invest, renovate, or find their dream home, the loan officer’s expertise is essential. This is especiallly critical as they navigate the bank-owned property landscape.

The loan officer works closely with appraisers, inspectors, and legal professionals to validate the property’s condition and market value. Transparency is also paramount throughout the process. The loan officer explains the terms of the bank-owned loan, including interest rates, repayment structures, and any associated costs. The culmination of the efforts is the closing stage. The loan officer oversees the coordination between the lender, title company, and any other relevant parties. This ensures a smooth transition from financing to property ownership.

Charles White, Vice President-Area Sales Leader, of Synovus Bank said about the different loan types you can find in MMI:

“With MMI, I can sort via loan type so I can see a lot of info and glean recent trends all in one screen. It can also depend on the market. Especially if in a market with heavy concentrations in specific loan types. Do I need more govies? Do I need more or less Port loans. Are those port loans to properties in our footprint? Data such as that. There are qualities some lender types might look for and this is where MMI shines. I can see who is doing construction-perm. Need VA/FHA/USDA? I can find someone doing those. A loan officer candidate says they do a lot of everything. Well, let’s see if that is true. That’s what I can learn with MMI. I can know what I didn’t know about the loan officer before the loan offiicer tells me their story. It’s invaluable”

MMI will also provide details like loan amount, estimated Lifetime Value, and reported sales price of a property. We also include on the lender and title company involved. As you learn how to check loan officer production, you’ll find that this type of information helps recruiters spot trends and also align candidate profiles with their historical performance.

A look at the percentage of Conventional Loans a loan officer transacted as part of total loan types from MMI.

A CONV loan, short for conventional loan, is a standard financing solution that empowers individuals to realize their dreams of homeownership. When clients seek a CONV loan, a loan officer serves as a knowledgeable advisor. Collaboration is essential in processing a CONV loan. The loan officer liaises with underwriters, appraisers, title companies, and other professionals. They do this to validate the property’s value, assess risk, and ensure regulatory compliance. Transparency is also key throughout the process. The loan officer explains the terms of the CONV loan, including interest rates, loan amounts, monthly payments, and closing costs.

At the closing stage, the loan officer oversees the coordination between the lender, title company, and the client. This helps to ensure a smooth transition from loan approval to homeownership.

An FHA loan, backed by the Federal Housing Administration, is a pathway to homeownership that provides individuals and families with a unique, valuable opportunity. This type of loan allows them to secure financing with more flexible terms and lower down payment requirements. A loan officer’s expertise plays a pivotal role in guiding clients through the intricacies of obtaining an FHA loan. This enables their clients to achieve their homeownership dreams.

The loan officer’s first step is to understand their homeownership goals and financial situation. Whether they’re first-time homebuyers or looking to refinance an existing mortgage, the loan officer’s insights shape the financing strategy tailored to their unique needs. Once eligibility is established, the loan officer guides clients through the application process. This involves gathering a variety of necessary documentation. This can includes income verification, tax returns, employment history, and other relevant financial details.

The loan officer also collaborates with underwriters, appraisers, and other professionals. They do this to assess property value, validate the condition of the property, and ensure compliance with FHA guidelines. The loan officer also explains the terms of the FHA loan, including interest rates, mortgage insurance premiums, and upfront costs. At closing, the loan officer oversees the coordination between the lender, title company, and the client. This ensures a seamless transition from loan approval to homeownership.

A VA loan, backed by the U.S. Department of Veterans Affairs, is a remarkable opportunity that extends gratitude to military service members and veterans by offering them a path to homeownership with favorable terms. When clients seek a VA loan, the loan officers steps into the role of a dedicated supporter of those who have served. The initial step is to understand their homeownership aspirations and their military service history. Whether they’re active-duty military, veterans, or eligible spouses, these insights shape a financing solution that reflects their unique needs and honors their service.

Once eligibility is established, the mortgage loan officer guides clients through the application process. The loan officer then collaborates with underwriters, appraisers, and other professionals. They do this to validate property value, assess the condition of the property, and ensure compliance with VA guidelines. At closing, the loan officer oversees the coordination between the lender, title company, and the client. This ensures a seamless transition from loan approval to homeownership.

A REV MTG loan is a financial solution that offers older homeowners an innovative way to tap into the equity they’ve built in their homes. This allows them to enhance their retirement years with financial stability and peace of mind. When clients seek a reverse mortgage, the loan officer becomes their expert guide on the path to financial security in retirement.

Financial analysis forms the foundation of the process. The loan officer evaluates the client’s age, home value, outstanding mortgage balance, and current interest rates to determine their eligibility for a reverse mortgage. Upon establishing eligibility, the loan officer guides clients through the application process. Throughout this exercise, the loan officer also works closely with appraisers, counselors, and legal experts. This is to validate property value, provide financial counseling, and ensure compliance with regulatory requirements. A transparent approach empowers clients to make informed decisions about their financing. All of this ensures that they understand the impact on their home equity.

During the closing stage, the loan officer oversees the coordination between the lender, title company, and the client. They do this to ensure a smooth transition from loan approval to accessing the funds they need. Processing a reverse mortgage isn’t just about providing financing. It’s about offering older homeowners a lifeline to a secure and comfortable retirement.

Understanding the geographic regions where a loan officer excels can influence your decision-making as it relates to market and territory expansion planning. Some loan officers might have a knack for specific areas, whether due to market expertise or established relationships with local agents. Once you’ve learned how to check loan officer production, you’ll find you can then use this to help prioritize candidates in the recruitment process.

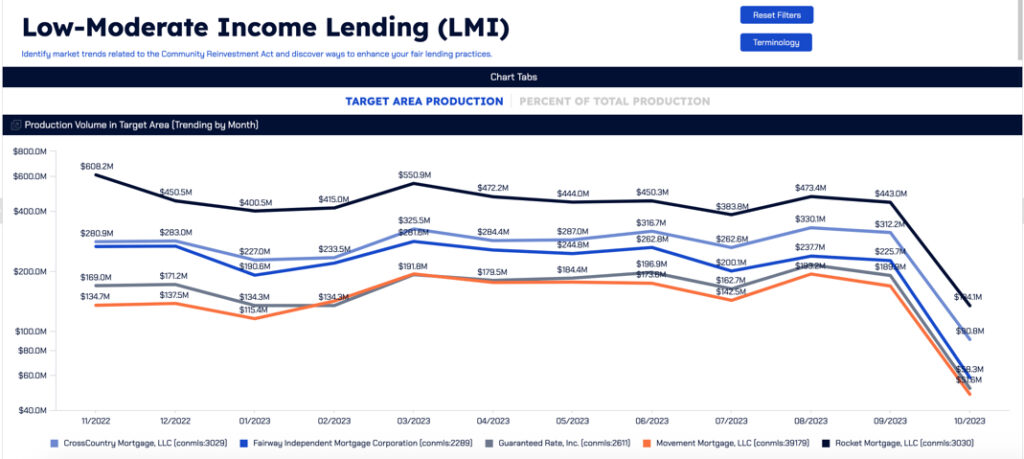

The Community Reinvestment Act (CRA) should also be considered as it impacts a loan officer and their emphasis on different areas of focus. Thie spans community engagement, lending to underserved populations, meeting CRA performance metrics, collaborating with community organizations, and adhering to fair lending practices.

Certain data platforms will also show you LMI-specific data trends.

Lastly, Lender Mortgage Insurance (LMI) can significantly impact the role of loan officers by expanding borrowing opportunities, enhancing affordability, and allowing for customized mortgage solutions. Loan officers who understand LMI and its implications are better equipped to guide borrowers toward suitable financing options that align with their financial goals and circumstances.

Agent relationships can significantly impact a loan officer’s success and this impacts how to check loan officer production. Evaluating the number of transactions with specific agent partners, their historical data, and their real estate company’s details gives recruiters an in-depth understanding of the officer’s network and collaboration history. The data given allows you to understand their wallet share as well, ultimately driving the bottom line. This collection of information helps you understand how you might strategically drive revenue through the expanded relationships new loan officers would bring to your organization.

In today’s dynamic job market, loan officers might switch roles if they don’t produce results within the first 30 days. Recruiters should look for loyal loan officers, but understand the current climate and use a tool like MMI to see employment history before the market changed. Look for continuity in their license history and that they always meet standards and guidelines for industry professionals. You can access that information within some of the database and data guidance systems offered.

Access unique transaction data to help gauge loan officer production and performance.

Embarking on a journey to leverage loan officer performance metrics demands a strategic approach. Follow these steps to implement all you’ve learned about how to check loan officer production and jumpstart your initiative:

Assess the tools you currently use for performance metrics. Are they meeting your needs? Identify any gaps in your current metrics arsenal. If certain performance metrics are missing, it might be time to explore new vendors.

Use the guidelines above to determine what production metrics you want to prioritize when recruiting new loan officers. Then ensure that the data solutions you have in place and provide accurate and actionable guidance.

Armed with the insights gained from performance metrics, target and recruit the identified top-performing loan officers. Our post about tools to recruit top loan officers helps explain this in more detail.

Recruiting top loan officers isn’t just about finding candidates with impressive resumes; it’s about understanding how to check loan officer production and identifying individuals who possess the right mix of productivity and efficiency to thrive in the mortgage lending landscape. By focusing on key performance metrics and utilizing tools like MMI, you can make informed decisions that enhance your team’s quality and drive your company’s success.

As Kortney Lane-Schafers, Director of Growth at MMI stated:

“I see recruiters, business development teams, and talent acquisition teams use many areas of MMI. It is key when organizations are looking for the “right fit” and MMI tells the story. The story is made up of numbers, trends, product types, agent relationships and more.

I have often referred back to the article where our CEO talks about MMI and building your team the same way sports teams build their roster. Here’s an example: If you are in need of a punter or a special teams guy then you start using the data and researching players by looking at their stats and analyzing the data to find the player that is going to fit that very specific role for your team to be positioned to win the championship. MMI is no different. If you need to find a loan officer in a very specific market, with very specific skills, and established loyal agent relationships already, then MMI can help you find the right person to add to your team!”

To learn more about MMI and how it can transform your loan officer recruitment efforts, request a demo today.